Home insurance premiums are soaring. Here’s how I saved $1,415!

Recent floods and extreme weather events mean home insurance premiums are skyrocketing in different areas. If you get slugged with a massive increase like I did, it's time to shop for a better deal.

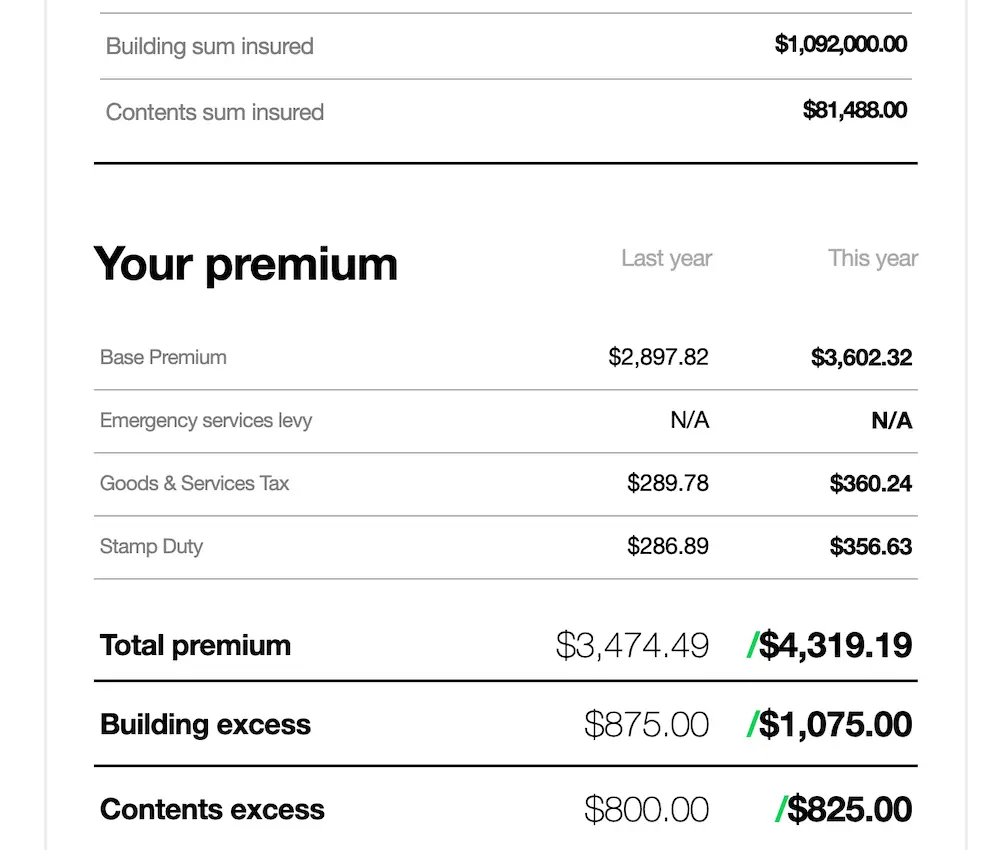

This week, I received my annual renewal notice from Youi. I've been with them for 11 years. But this year, I'll be moving elsewhere…

I called my insurer to see what they could do about this whopping increase. They tweaked a little, but the best they could do was reduce it to $4,284.36 unless I substantially increase the excess. This figure is the price if I pay it in a lump sum, too – it's more than 10% higher (almost $5K total!) if I opt to pay it by the month.

Insurer: Youi (current)

Building insurance coverage: $1.092m

Contents insurance coverage: $81,500

Excess: $1,075 for building, $875 for contents

Notes:

- Includes 20% extra for debris removal and clean-up.

- Includes flood cover and accidental damage.

Premium: $4,284.36 (more expensive if you pay monthly)

Every insurer prices their premiums differently, according to their own risks and payouts. So, clearly it was time to shop around! I took a look at some home and contents insurance options on Finder for my 4-bedroom, 3-bathroom, split-level home on the Gold Coast:

Insurer: Honey

Building insurance coverage: $1.1m

Contents insurance coverage: $80,000

Excess: $750 for building, $750 for contents

Notes:

- Includes 20% extra for demolition and up to 10% for costs to redesign your home.

- Includes flood cover and accidental damage.

- Includes a discount that requires you to install sensors, to alert you to leaks and heat/fire.

- When I entered "yes" to having a claim within 3 years, they wouldn't insure me.

- Jumped up to $2,929 when I put my DOB in; down to $2,904 with husband's DOB

(7 years older).

Premium: $2,889.00 (same price if you pay monthly)

Insurer: Budget Direct

Building insurance coverage: $1.1m

Contents insurance coverage: $80,000

Excess: $750 for building, $750 for contents

Notes:

- Basic policy: flood, accidental, motor burnout, personal effects all cost extra

Premium: $2,580.78 (more expensive if you pay monthly)

Insurer: Qantas Insurance

Building insurance coverage: $1.1m

Contents insurance coverage: $80,000

Excess: $750 for building, $750 for contents

Notes:

- Includes 10% extra for demolition and debris.

- No flood cover, no motor burnout, no accidental cover.

- 20,000 Qantas points up for grabs at time of obtaining quote.

Premium: $3,223.00 (more expensive if you pay monthly)

Insurer: Woolworths Insurance

Building insurance coverage: $1.1m

Contents insurance coverage: $80,000

Excess: $750 for building, $750 for contents

Notes:

- A basic policy without accidental coverage was $3,630, and it's an extra $67/year for motor burnout.

- No additional coverage for debris removal and clean-up.

- Includes a 10% Woolworths discount on groceries per month.

Premium: $3,983.56 (more expensive if you pay monthly)

I also tried one more insurer, as I'm an existing long-term health insurance customer with ahm – I wanted to see if the loyalty discount they offered of 20% would amount to much.

Insurer: ahm

Building insurance coverage: $1.1m

Contents insurance coverage: $80,000

Excess: $750 for building, $750 for contents

Notes:

- Includes flood cover and accidental damage; extra $67/year for motor burnout

- No additional coverage for debris removal and clean-up.

- Includes a 20% discount for being an existing customer.

Premium: $3,268.00 (more expensive if you pay monthly)

Final verdict

First, a few things I learnt along the way:

- Quotes seem to get cheaper for older policyholders. Some insurers asked to list the oldest policy holder straight off the bat, but some quotes automatically increased once I added my date of birth.

- Not all policies are created equal! Some make it super clear they're "basic" policies, and for others, you have to dig through the details to work out what they do and don't cover. It's also important to note that different homes and risks are insured differently, so the prices you get with the above insurers could be wildly different to what I got.

- Before you start shopping, be really clear about what you want. All insurers cover fires (including bushfires), storms and theft. But lots differ on flood, motor burnout, accidental damage and extra money towards clean-up/debris.

- Insure your home for the correct amount. You'll need to estimate how much you think it would cost to rebuild your home if it was destroyed. This is called the sum insured. I increased my sum insured last year from $800,000 to $1.1m because construction costs have gone up so much; if I selected a sum insured of $800,000 but it cost $1.1 million to rebuild my home, I'd be $300,000 out of pocket (or I'd have to rebuild a much smaller home).

- Comparing doesn't take as long as you'd think. I compared quotes online and in just over 1 hour, had all of these options and I was ready to make a decision.

My new insurer: Honey

It's not the cheapest premium in the mix, but it's the best value for money as it includes full coverage for floods, accidental damage and clean-up fees. It's also a saving of $1,415 against my renewal with my existing insurer.

Has your home insurance gone up? See if you could save like Sarah. Compare policies side by side or get started with our best home insurance page.

Ask a question