Inflation sinks to 4.1%: Why should you care?

Hurrah! Rejoice! Inflation is finally falling! But what does that actually mean for you?

Inflation of 4.1% means that on average, what cost $100 a year ago costs $104.10 now.

Inflation is now falling – which means a few things, depending on your current situation.

If you exist in the world – buying groceries, shopping and spending:

The crazy price increases we've been copping on everything from cheese to Chinese takeaways should calm down.

Inflation is basically the difference between what something costs now, and how much it cost 12 months ago. So inflation of 4.1% means that on average, whatever cost you $100 this time a year ago costs you $104.10 now. When inflation was around 7%, something that previously cost $100 leapt to $107.

These are averages: some singular items experienced much greater jumps. The 1kg block of cheese I buy every fortnight jumped from $7 to $10.50. This is unlikely to drop back to $7.

Although we will catch a few breaks. Mark Crosby from Monash University notes that "some staples such as fuel are likely to continue to fall in price".

Bottom line: the end of high inflation should also mean the end of these big increases.

If you have a mortgage:

Finally, FINALLY! A reprieve from the record-breaking run of interest rate hikes that saw the average $600,000 mortgage balloon by $15,000 a year, or more than $1,000 a month.

Inflation is 4.1%, and the RBA would like to see it fall to 2–3%. So, we're not there yet. But as Peter Boehm from Pathfinder Consulting says, we're heading in the right direction.

"By mid-year we should see rates come down by at least 50 basis points over the second half of 2024, as inflation heads towards the target range," Boehm says.

Bottom line: rates – and therefore your mortgage repayments – should stay stable for the next few months, then start falling in the second half of 2024.

If you have savings in the bank:

Those with savings AND a mortgage should probably have an offset account instead – this way you'll pay no tax on your savings interest and you'll pay less interest on your mortgage.

For everyone else, falling inflation and eventually falling interest rates means you'll get less of a return in your savings account.

How much can we expect savings rates to fall? Boehm predicts around half a percentage point this year: "Inflation appears to be heading in the right direction… I expect there will be little change during the first half of the year, subject to any inflation shocks, and by mid-year we should see rates come down by at least 50 bp."

One thing we can count on: when those rate cuts do come from the RBA, banks will pass them through with immediate effect.

Bottom line: If you have a decent amount of savings and you don't need to access it right away, now is a good time to lock in a great rate in a term deposit.

If you own a business:

Anneke Thompson, chief economist at CreditorWatch, says the next 6 months "will remain very challenging".

"The lag effect of monetary policy impacts is now being felt, and business confidence and conditions are slowing… It's unlikely confidence will return to consumers until there is any real sign of upcoming interest rate cuts," she says.

The minor silver lining? Businesses have copped an increase in raw costs due to inflation as well, so at least their outgoings are set to moderate too.

Most importantly: now that inflation is falling, when will rates start to fall, too?

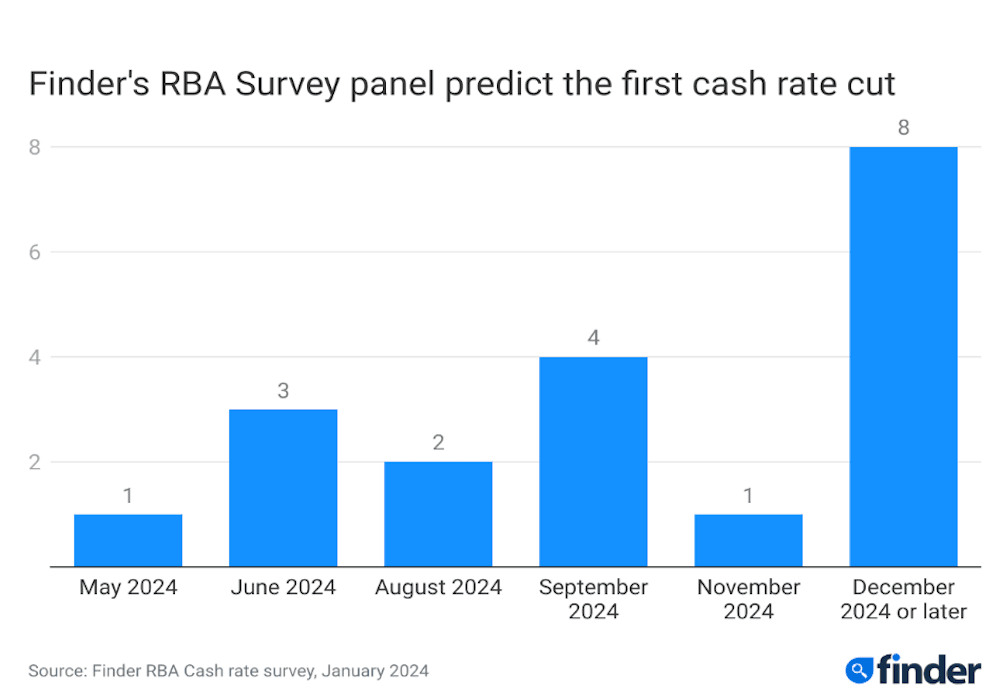

In Finder's RBA Cash Rate Survey™, 1 in 3 panellists shared that they predict a cash rate cut by August this year:

But Thompson predicts it could be as soon as Easter.

"An unemployment rate rising more sharply than forecast could convince the RBA to bring cash rate cuts forward into the second quarter of 2024, and slowing business conditions means there is an ever increasing possibility this could happen," she says.

Bottom line: Stay up to date on the latest news about inflation, interest rates, the economy and everyday costs – with tips to help you save money – in our cost of living hub.

Sources

Ask a question