Proven way for millennials to save a $100,000 home deposit

Living at home with mum and dad for a few extra years could pave your pathway to property ownership.

New Finder research has revealed just how much you can save for a house deposit by delaying moving out of home a few years, and you don't have to give up smashed avo, online shopping or your daily caffeine hit to make it work.

The potential savings are staggering – we’re talking six-figures in your bank account, instead of swiped from your paycheque to pay for rent, bills and groceries.

Finder’s research and insights team analysed the average cost of living in a rental property to come up with some figures.

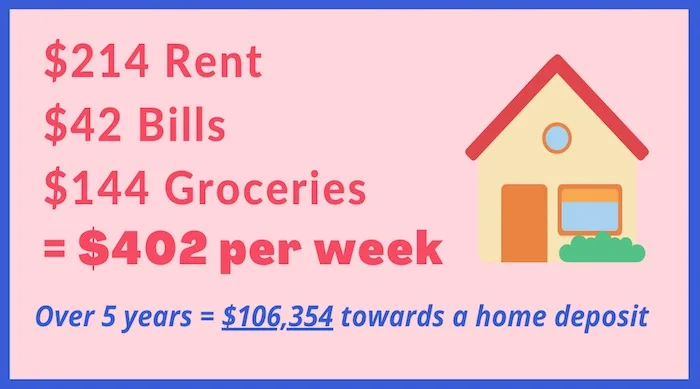

When you factor in rent ($214), bills ($42) and groceries ($144) to calculate the potential savings you could make, it’s clear to see how choosing to live at home over a five-year period could set you up to buy your first home.

Based on the above figures, it amounts to a weekly cost of living out of home of $402.

This quickly adds up to $20,921 per renter per year. Over 5 years, this is a whopping $106,354!

It’s more than enough for a substantial deposit on your first home, and it's achievable simply by choosing to live at home with your parents instead of moving into a rental with mates.

The key to making this super-charged savings strategy work

First, you have to consider the obvious lifestyle impacts of living at home. If your parents' home is in the outer suburbs and you find yourself forking out for expensive Uber rides home from the city every weekend, you might cancel out any real savings and waste your opportunity of living at home for no real financial gain.

Also, as the renter in this scenario, you need to commit to being a diligent saver and you need parents who are financially settled enough to charge you next to nix in rent. Realistically, the only way you can save a decent amount of money is if your parents don’t charge you much rent and cover the majority of the bills.

Because you’re not paying daily bills to get by, you need to commit to a regular savings plan. You then need to act like you are paying bills and put money into a savings account each week, religiously.

This doesn’t mean you have to forgo every creature comfort you enjoy: daily coffees, buying lunch, drinks after work and the odd online shopping splurge are still totally on the table. But if you find yourself burning through 80-90% of your paycheque each week, then you won’t make headway towards your home loan deposit goal.

Save a home deposit by living at home longer

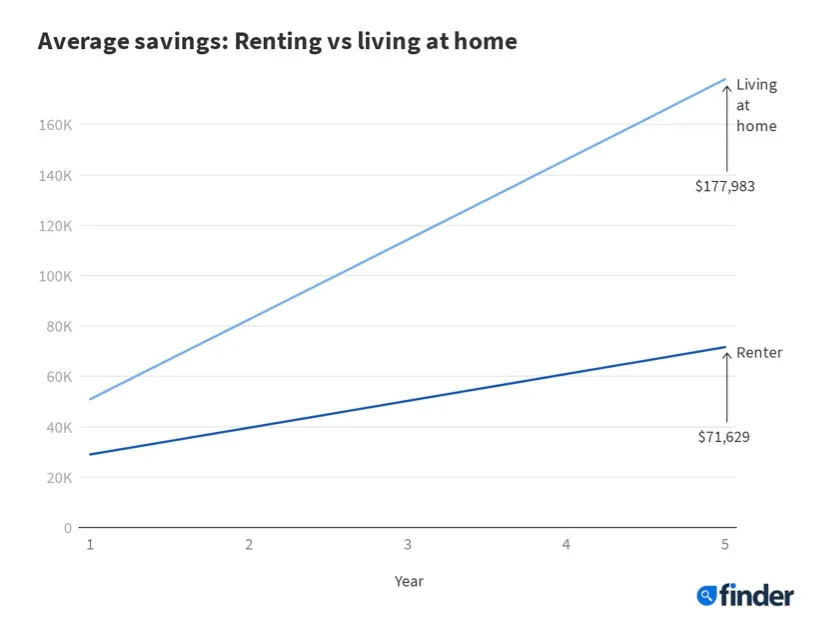

If this sounds like a plausible plan, then based on Finder’s figures, if the average generation Z or millennial stashed $402 a week into a savings account, you could accrue an average of $106,354 over five years.

There’s no shame in living at home a little longer, either. Last year, a Finder survey of 1,025 respondents revealed one in four (26%) households had adult kids over the age of 21 living with their parents. In 21% of these households, adult kids had moved back in as a result of the pandemic.

Finder research also found that 44% of parents with adult kids help them out financially.

Living with mum and dad is not always an option and for renters trying to save for a home, all is not lost. In a similar vein, being super disciplined is key: You need to create a budget strategy to meet your deposit goal and try not to dip into your savings account unless it’s a genuine emergency.

Your best bet is to set yourself a timeframe for buying a home, then work out how much you need to save each month to meet your target. Consider moving to a cheaper suburb or downsizing to a smaller place, because even a small difference in your weekly rent could save you thousands of dollars a year.

Getting on top of your finances is the first step towards building a deposit and buying a home: get started with the Finder app today

Methodology:

- Finder calculated the weekly cost of living in a rental property, including rent, bills, groceries and on-off purchases.

- Average cost data was sourced from:

- CoreLogic median rental prices for all capital cities

- Finder analysis of the cost of utilities and Internet

- Budget Direct estimates of average weekly food and alcohol spend for adults under 35

- Coles Online data for the price of cleaning products

- IKEA data for the price of basic furniture items

- Kmart data for the price of household goods

- The Good Guys data for the price of appliances.

- Weekly cost data were extrapolated with a constant interest rate of 0.25% applied to calculate the potential savings if that money had been put into a savings account instead.

- In both the renting and living at home scenarios, the analysis assumes an initial cash savings of $18,442, with an additional $876 added to savings each month. This is based on generation Y and generation Z data from Finder’s Consumer Sentiment Tracker (9,097 respondents).

- Finder extrapolated the potential savings for the renter for an additional 10 years to find that by year 15 of renting, they would have $180,017 in savings (assuming a constant interest rate, income and savings rate). In comparison, the person living at home would have accrued approximately that same amount ($177,983) within five years.

Ask a question