Drowning in debt: Mortgage stress hits all time high

A staggering number of mortgage holders are barely keeping their heads above water, according to new research by Finder.

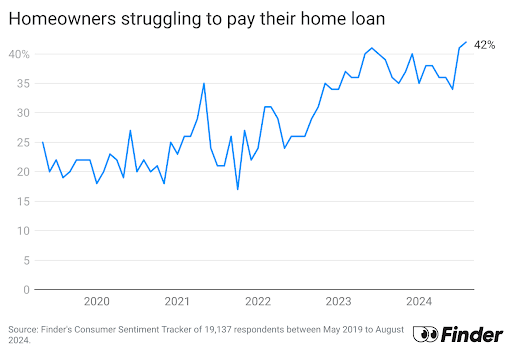

In August, Finder's Consumer Sentiment Tracker recorded the highest level of mortgage stress since it first began tracking in early 2019.

More than 2 in 5 (42%) homeowners struggled to pay their home loans in August – an estimated 1.4 million mortgagors in distress.

On top of this, Finder research reveals 13% have missed one or more mortgage repayments in the past 6 months.

Owner-occupiers are, on average, taking out larger loans than ever before despite the fact the cash rate is sitting at a 12-year-high.

The average owner-occupier mortgage is now $634,479, which is up by 1.3% from the previous month and up by 9.3% from the previous year, according to data from the Australian Bureau of Statistics.

Richard Whitten, home loans expert at Finder, said many Australians are spending a disproportionate amount of their income on their home loans.

"Million of mortgage holders have managed rate hikes so far, but now they're facing severe financial strain as their savings and emergency funds dry up.

"Housing is increasingly becoming a major source of stress for Australians, with many struggling to keep afloat."

To help Australians make better financial decisions when it comes to their home loan, Finder has today revealed the winners of its 2024 Customer Satisfaction Home Loan Awards .

Finder polled over 10,000 Australians across the Customer Satisfaction Awards program to determine the winners of the home loan awards.

Whitten said brands were rated by Aussie's across a range of metrics like fees and interest rates, customer service, features and benefits and ease of application.

"ING was crowned most loved brand in the home overall loans category, while NAB took the top spot for most trusted brand .

" Bendigo Bank was awarded the top gong for legendary customer service ."

In the owner occupier home loans category, ING was awarded most loved brand and most trusted brand , and Bendigo Bank reigned supreme for legendary customer service.

Commbank claimed the top spot for most loved brand and legendary customer service in the investor home loans category, while Macquarie Bank was recognised as most trusted brand .

Click here for more information on Finder's Home Loan Customer Satisfaction Awards 2024.

Whitten said if your mortgage is more than 30% of your take home payment then you're likely experiencing housing stress.

"The number of people struggling to make their home loan repayments has reached a disturbing level.

"Rapidly rising interest rates have put first-time homeowners in a very precarious situation."

Whitten said if there was ever a time to reassess your home loan it is now.

"Evaluate rates from various lenders to ensure you're not overpaying - the winners of Finder's Home Loan Customer Satisfaction Awards 2024 are a great place to start.

"Also compare what your lender offers new customers. You might be able to negotiate a better deal with your current lender, which is easier than switching to a new one.

"But if your lender won't budge, ditch them for a better offer. In the home loan game, loyalty is for suckers."

ABS data shows almost 14,000 mortgage holders negotiated a better rate from their current lender in June 2024.

Whitten urged homeowners to allocate any tax returns they may receive to their mortgage and emergency fund.

"Making ad hoc payments can make a huge difference in the long run."

Sources

Methodology

- Finder's Consumer Sentiment Tracker is a monthly recurring nationally representative survey of more than 60,000 respondents.

- Figures in this release are based on 19,137 mortgage holders between May 2019 and August 2024, and 333 mortgage holders for August 2024.

- The Consumer Sentiment Tracker is owned by Finder and operated by Qualtrics, an SAP company.

- The survey has been running monthly since May 2019.

Ask a question