RBA’s 10th rate hike hits: Can you afford another mortgage rate rise?

36% of Aussies say they're struggling to make home loan repayments.

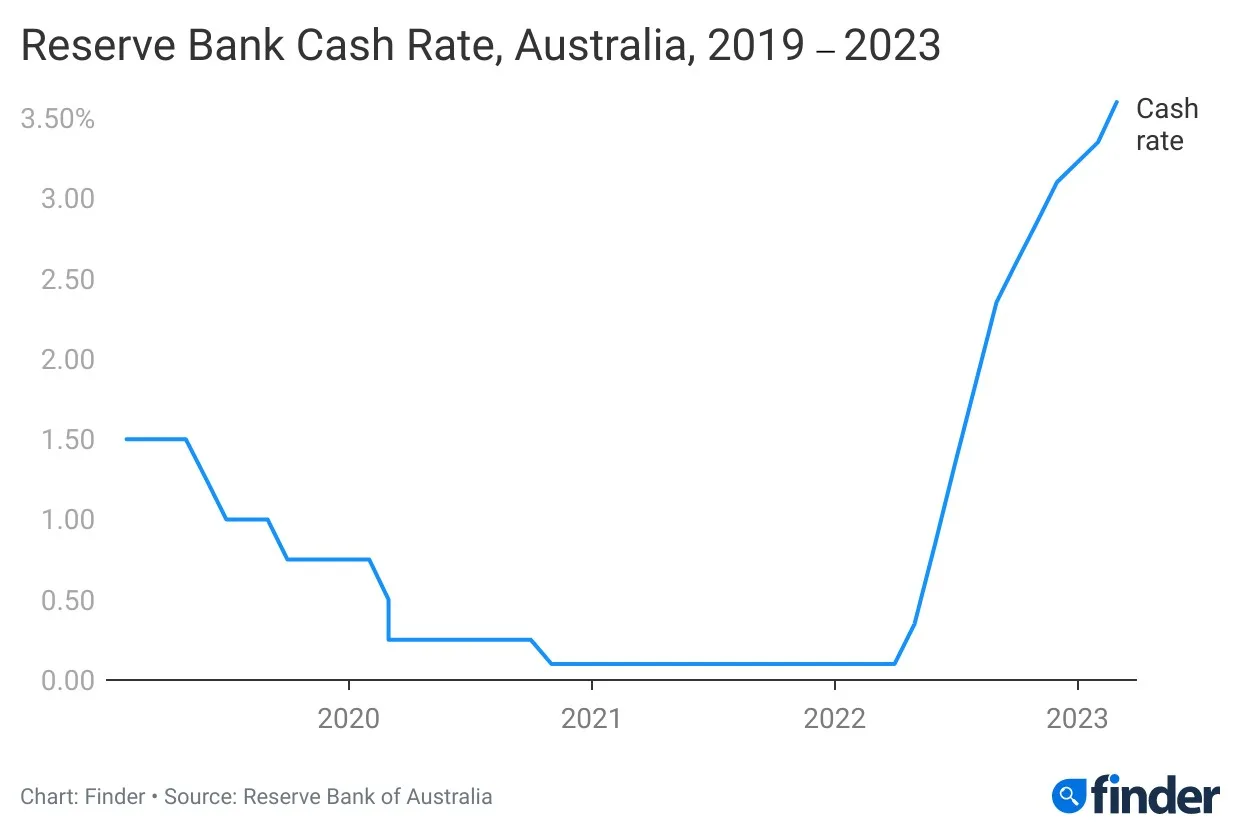

The Reserve Bank of Australia (RBA) lifted the cash rate to 3.60% today, the highest the rate has been since 2012.

93% of the experts in Finder's RBA cash rate survey predicted today's decision.

The move comes as Australia, and the world, continues to deal with soaring inflation. And while inflation in Australia appears to be improving, most experts predict more rate rises to come before they fall.

36% of Australian borrowers are struggling

According to Finder's Consumer Sentiment Tracker, 36% of Australians say they're struggling with home loan repayments.

This is hardly surprising given how fast rates have risen.

Counting the cost of rate rises

Every rate rise makes your home loan more expensive, but taken together the RBA has now lifted rates 10 times, starting in May of last year.

If you had a $500,000 home loan with a rate of 2.20% in April 2022, your rate today would likely be 5.70%, assuming your lender passed on every rate rise, including today's.

Assuming a 30-year loan term, it's a stark difference:

- Monthly repayments at 2.20% = $1,899

- Monthly repayments at 5.70% = $2,903

That's an extra $1,004 a month! Or $12,048 in a year.

Tips for borrowers feeling the pain

- Review your home loan. Your lender will likely pass on today's rate rise in a week or so. It really helps to know what your rate currently is.

- Check if your current lender has a better deal. Sometimes your own lender has a better deal on its website. The catch? It's for new borrowers, not loyal, existing borrowers. If you call and ask, your lender will most likely match the rate.

- Refinance to a lower rate. If you can't get a better deal with your lender then start looking at rates from other lenders and look for a better deal. Even a slightly lower rate can save you quite a bit. Refinancing is not as hard as you think.

- Find other ways to budget and cut back. While your home loan is probably your biggest expense, see if you can't find savings on groceries, insurance or other big expenses.

If you can't make repayments, talk to your lender. If the rate rises have pushed you beyond your limits completely, talk to your lender. You may be able to negotiate a repayment holiday, interest-only repayments or some kind of hardship assistance scheme.

Compare the latest home loan rates and find a better deal, or download the Finder app to keep track of your money all in one place.

Ask a question