Finder’s RBA cash rate survey November 2024: Mortgage stress hits all-time high but cash rate tipped to hold

Homeowners have been pushed to the brink, with many forced to sell their homes if relief doesn't arrive soon.

In Finder RBA Cash Rate Survey™ for November 2024, 38 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

All experts (100%, 38/38) believe the RBA will hold the cash rate at 4.35% in November.

Graham Cooke, head of consumer research at Finder, said despite inflation shrinking to its lowest level since 2021, it doesn't look likely the RBA will cut rates this month.

"Homeowners eagerly awaiting a rate cut before Christmas will have to hold on a bit longer for some relief.

"However, the good news is that 2025 will almost definitely bring multiple rate cuts."

Leanne Pilkington from Laing+Simmons said it appears the RBA is set on waiting for a consistent downward trend in inflation to materialise.

"The signs are there though, so a rate reduction is warranted in the near term," Pilkington said.

Matthew Greenwood-Nimmo from University of Melbourne said although headline inflation has dropped within the RBA's target band, the trimmed mean measure is still above 3%.

"I suspect the RBA will keep the cash rate where it is until the trimmed mean has come down further," Greenwood-Nimmo said.

Record number of homeowners facing mortgage stress

Aussie households are preparing for a tough Christmas with a record 47% struggling to pay their home loan amid unrelenting pressure from interest rates.

This is the highest level since Finder began surveying Australians on this topic in May 2019.

The research found 1 in 7 (14%) – 462,000 borrowers – have said they'd have to sell or apply for hardship if interest rates remained the same until February.

Almost 2 in 5 (39%) – equivalent to 1.3 million mortgage holders – would have to cut back spending to afford their mortgage over the coming four months.

Graham Cooke said Australian homeowners are teetering on the brink of financial crisis, burdened by soaring mortgage repayments.

"With emergency savings depleted and the RBA yet to signal significant rate cuts, many fear their livelihoods are at stake.

"As the new year looms, urgent relief may be needed to prevent a wave of financial hardship."

Cooke urged homeowners to tighten their belts this Christmas.

"Reach out to your lender now to negotiate a lower interest rate and ease your financial burden before the year ends.

"If they refuse to lower the rate, it might be time to explore refinancing options," Cooke said.

Experts agree global rate cuts won't sway RBA's stance

Almost 3 in 4 economists who weighed in* (71%, 22/31) believe the recent cash rate cuts in New Zealand and the United States will not make it more likely for the RBA to cut rates.

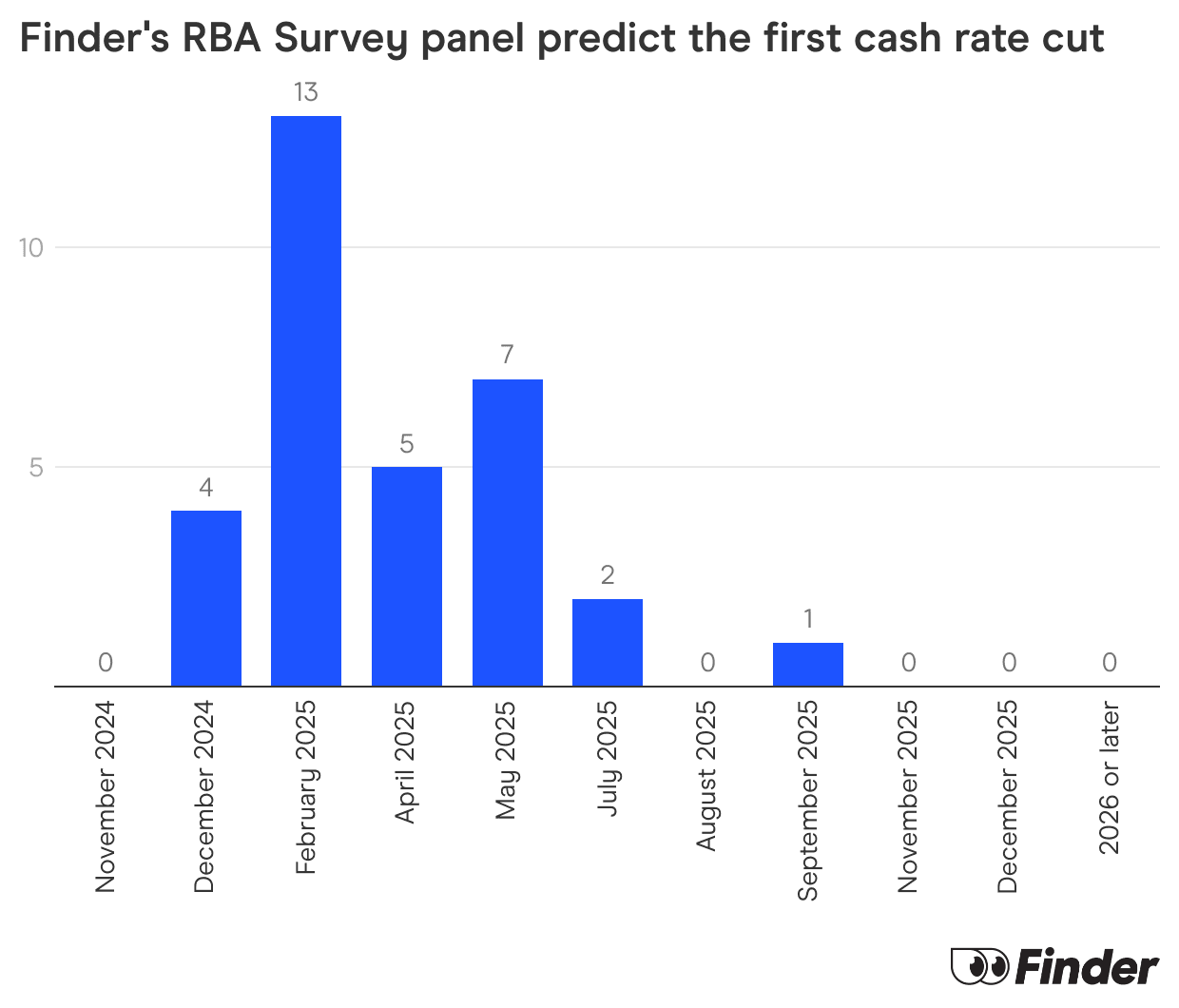

However, the majority of experts (78%, 25/32) still forecast a rate cut in the first 3 meetings of next year – up from 68% last month.

David Robertson from Bendigo Bank said the RBA has lagged behind other central banks in its rate-hiking cycle.

"The RBA remains around 6 months behind other central banks such as the US and New Zealand who initiated their tightening cycles earlier, and hiked rates by significantly more," Robertson said.

Shane Oliver from AMP said rate cuts overseas won't automatically lead the RBA to cut rates in Australia.

"Rate cuts in the US, NZ and other comparable countries are a positive sign that global inflation is coming under control but they won't on their own cause the RBA to cut [rates] as it will focus on Australian economic conditions," Oliver said.

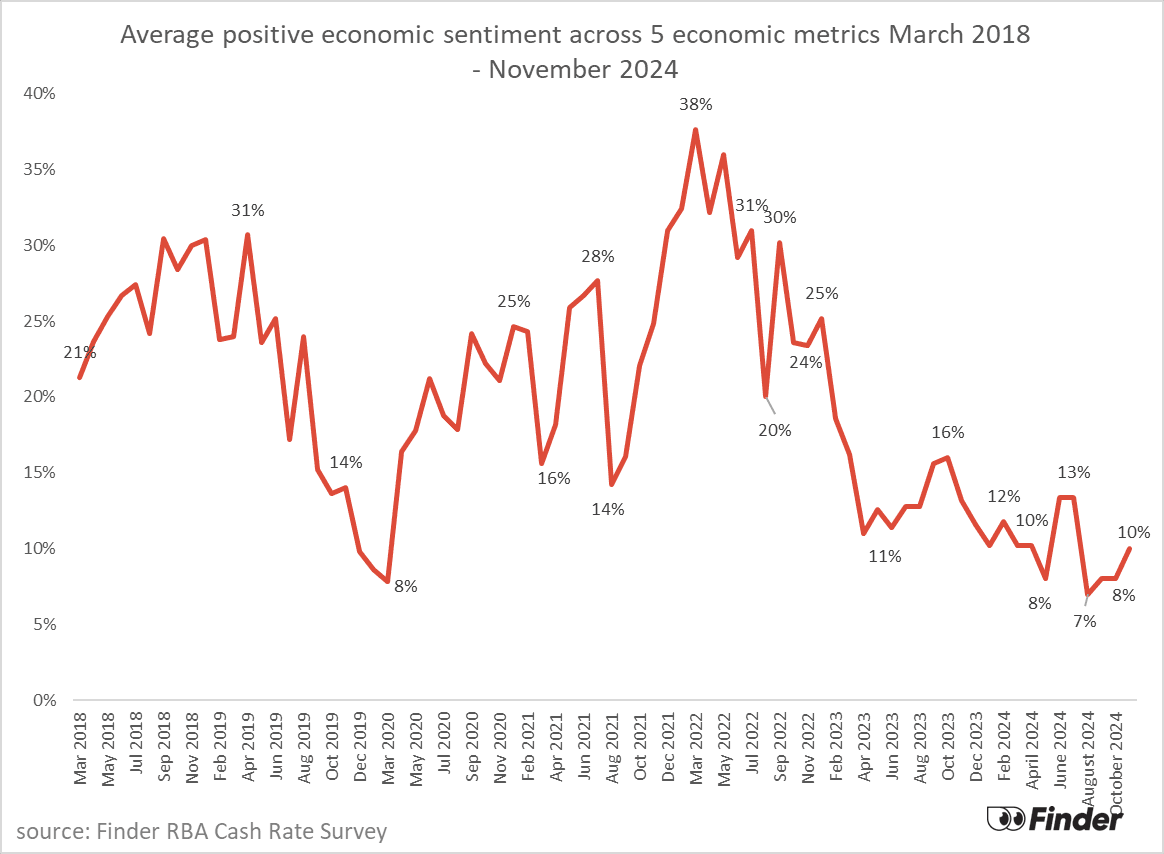

Economic sentiment is tracking upwards

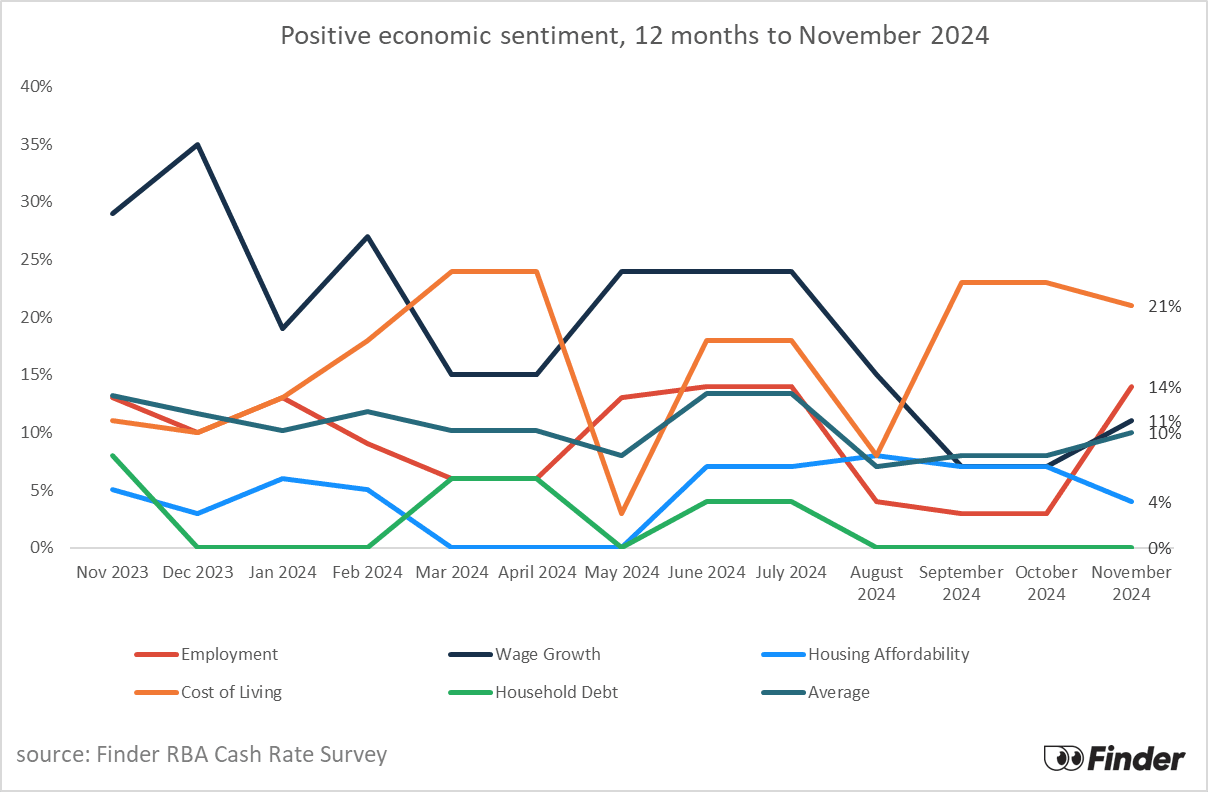

Finder's Economic Sentiment Tracker gauges experts' confidence in 5 key indicators over the upcoming 6 months: housing affordability, employment, wage growth, cost of living and household debt.

Average positive economic sentiment is trickling upwards at 10% in November, up from its lowest point at 7% in August.

Housing affordability and household debt continues to remain a problem with 67% and 63% respectively expressing concern.

Positivity towards employment is high at 14%.

*Experts are not required to answer every question in the survey

Here's what our experts had to say:

David Robertson, Bendigo Bank (Hold): "The quarterly inflation data continued the pleasing trend of moderating inflation in line with our forecast of rate cuts next year, but not sufficient progress with core inflation to change our view that the first cut is most likely in May. It would be helpful if that first cut is 35bp to an even 4%."

Aarti Singh, University of Sydney (Hold): "The good news is that the latest CPI number is within the RBA's band. Moreover, this decline was expected by the market. However since other measures of CPI that exclude the more volatile items are still outside the band, RBA may wait before lowering rates."

Tomasz Wozniak, University of Melbourne (Hold): "We're not moving anywhere! ...for now! The forecasts from all my models indicate a decisive HOLD for November. They also indicate a slight downward pressure for the coming months. I interpret these predictions as a clear expectation of cuts in the cash rate but at an uncertain horizon. Forecasting the breakpoint is always tricky, and the upcoming data announcements will play a decisive role in shaping the forecasted trajectories in the following months. You can access these forecasts at https://forecasting-cash-rate.github.io/."

Matthew Greenwood-Nimmo, University of Melbourne (Hold): "Although headline inflation has dropped within the RBA's target band, the trimmed mean measure is still above 3%. I suspect the RBA will keep the cash rate where it is until the trimmed mean has come down further."

Brodie Haupt, WLTH (Hold): "We're trending in the right direction as CPI inflation eases to 2.8%, marking a return to the RBA's target range of 2%-3%. However, underlying inflation remains at 3.5% so the decision to hold still remains likely."

Andrew Wilson, My Housing Market (Hold): "Inflation preferred measure still above target range."

Anthony Waldron, Mortgage Choice (Hold): "I believe the Reserve Bank will keep the cash rate on hold in November. ABS data shows that underlying inflation remains higher than desired, and the labour market recorded a strong rise in employment in September, which could put upward pressure on inflation. While the next time rates move, they're expected to go down, borrowers might have to wait a few more months to see this change."

Shane Oliver, AMP (Hold): "Inflation is likely still too high to see the RBA cutting in November. But it is falling and likely to continue to do so resulting in a start to rate cuts in February next year. A December cut is still possible but would need to see a further sharp fall in underlying inflation in October monthly data along with a renewed rise in unemployment."

Leanne Pilkington, Laing+Simmons (Hold): "While many consumers will be hoping for a rate cut prior to Christmas it appears the RBA is set on waiting for a consistent downward trend in inflation to materialise. The signs are there though, so a rate reduction is warranted in the near term."

Mark Crosby, Monash University (Hold): "The latest fall in inflation will be good news but the RBA will wait longer to see that falls in inflation are entrenched. A weakening economy will see rate cuts sooner, but more likely the first half of next year will see the first rate cut."

Nalini Prasad, UNSW Sydney (Hold): "While inflation is trending down, it's still higher than where it needs to be. I think the RBA will want to wait to see if it falls further in the fourth quarter."

Tim Nelson, Griffith University (Hold): "Inflation down to 2.8 percent. RBA is likely to wait for more data before cutting."

Dale Gillham, Wealth Within (Hold): "Whilst inflation is getting under control we are not really seeing it reducing as fast as the RBA would like. On top of this is that the RBA is always a little slow when it comes to reducing rates, so a cut in the short term is unlikely."

Evgenia Dechter, UNSW (Hold): "Prices continue to rise beyond desired levels, and with the labour market remaining strong, rate cuts are unlikely before 2025."

Stephen Miller, GSFM (Hold): "The labour market is in satisfactory shape but inflation is proving "sticky"."

Stella Huangfu, University of Sydney (Hold): "The September quarter CPI inflation rate fell to 2.8%, the lowest since March 2021, and this marks the first time inflation is within the RBA's target range of 2-3%. However, it's premature to consider a rate cut at this stage, particularly with the RBA board not meeting in January."

Devika Shivadekar, RSM Australia (Hold): "Inflation is easing in line with expectations with headline breaking into the upper end of the RBA's target range in the Sept-24 quarter. However, persistent labour market tightness limits the RBA's flexibility to ease. Holiday season spending could indicate whether demand is sustainably strong or just temporary, impacting RBA's rate plans well into 2025."

Jeffrey Sheen, Macquarie University (Hold): "Q3 2024 headline inflation fell to 2.8%, inside the RBA's target range. Core inflation also fell to reach 3.5%, just above the range. Inflation expectations of consumers and business remain anchored in the range. While these outcomes are consistent with a monetary policy pivot in November, the RBA is likely to remain cautious. There is a growing downside risk of further delay."

Geoffrey Kingston, Macquarie University Business School (Hold): "Higher for longer remains the watchword for the cash rate. September did see falls in both the headline and core inflation rates. However, the core rate is still outside the target band, the labour market is still fairly strong and public spending remains elevated. With a federal election likely in the first half of next year, it's hard to see a spending cut any time soon."

Mathew Tiller, LJ Hooker Group (Hold): "Despite headline inflation falling to 2.8%, underlying inflation remains elevated at 3.5%, driven by persistent price pressures in services and housing. A strong jobs market and steady wage growth add further inflationary pressure, making the RBA cautious about easing too soon. Temporary government rebates on energy and lower fuel costs are masking core inflation, making a rate cut unlikely until early 2025. For real estate markets, this means demand is expected to stay steady, listings will continue to grow and this will see price growth moderate further."

James Morley, University of Sydney (Hold): "The RBA will look through the temporary fall in headline CPI due to energy rebates and will want to see progress on underlying inflation. If that progress happens for Q3 and labour market indicators start surprising on the downside, they could start cutting in December. But I expect the first cut will be in February. I also think there will only be about three cuts in 2025 unless conditions deteriorate rapidly. The more likely scenario is a weak, but growing economy for which the RBA will want to test what the neutral level of interest rates is before cutting too far below somewhere in the 3.35-3.84% range."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Hold): "The September quarter 'underlying' inflation numbers were in line with the RBA's expectations and not 'good' enough to give it the confidence it needs that underlying inflation is heading 'sustainably' back to its target band to justify cutting rates in either November or December. However the December quarter CPI numbers due in late January should be good enough to allow for a rate cut in February."

Garry Barrett, University of Sydney (Hold): "Headline and underlying inflation easing, though not yet within target range."

Cameron Kusher, REA Group (Hold): "We've just received Sep 24 quarter inflation data and although headline inflation is back in the target range largely due to temporary cost-of-living relief, underlying inflation at +0.8% for the quarter is still growing too fast to reach the 2% to 3% target range. Underlying inflation also hasn't printed below +0.8% since Jun 21 so I can't see a situation whereby this print materially changes the outlook for interest rates."

Nicholas Gruen, Lateral Economics (Hold): "They should probably cut now, but they're being 'careful' (as they see it)."

Sean Langcake, Oxford Economics (Hold): "Headline inflation will fall sharply in the Q3 print, but the RBA's focus will be on the trimmed mean measure. Unit labour cost growth is still too high for them to start cutting rates."

Nicholas Frappell, ABC Refinery (Hold): "Inflation and labour market strength."

Stephen Koukoulas, Market Economics (Hold): "Weak growth, low inflation, rising unemployment."

Michael Yardney, Metropole Property Strategists (Hold): "The first RBA rate cut has now been pushed out due to our relatively strong economy, strong job creation and low unemployment levels. While a rate cut by the end of 2024 is possible, it's more likely to occur in early 2025, depending heavily on inflation and employment metrics."

Tim Reardon, HIA (Hold): "Inflation will be increasingly sticky given embedded factors: excise indexation, rapid population growth leading to house price and rental price growth, labour shortages."

Noel Whittaker, QUT (Hold): "There is no evidence that Australia is getting inflation under control. With a federal election due in less than six months you can bet there'll be huge spending from the current government between now and election day. On top are promises from both the government and the opposition that they will embark on major building projects to solve the housing crisis. Talk to any builder and they'll tell you there's massive problems with costs and getting skilled labour. I don't see inflation dropping in these conditions."

Rich Harvey, PROPERTYBUYER (Hold): "RBA is steadfast on commitment to getting inflation back into their preferred range and don't wish to reignite the pressures."

Peter Boehm, Pathfinder Consulting (Hold): "I have been bearish on the direction of interest rates for quite some time now because (as I have been consistently saying) Federal Government spending is effectively pushing/keeping up the price of goods and services in this country. This view has now been independently vindicated by the IMF which recently published its forecast for Australia's headline inflation rate over the next year or so – and it's not a pretty read. The IMF is forecasting inflation to stay above 3% throughout 2025, and hit a peak of 3.6% Further, its forecast indicates Australia will have the second highest inflation rate among the world's advanced economies. For this reason I cannot see interest rates in Australia falling any time soon and there is the real possibility we won't see downward movement until 2026."

Matt Turner, GSC Finance Solutions (Hold): "Inflation seems to be more in line with the target band however there is still stress in housing costs as well as food at the supermarket. By cutting too early the RBA potentially lights a match for the property market with renewed confidence which in turn could lead to further inflation in that sector. I also believe that cutting pre-Christmas would be an invitation for people to spend as the first cut will be a psychological barrier that is removed for a lot of households. We are certainly seeing more confidence amongst our client base."

Jakob Madsen, (Hold): "Inflation has come down a bit and the economic activity is steady at the moment."

A/Prof Mark Melatos, School of Economics, University of Sydney (Hold): "Monthly inflation readings since last quarterly CPI announcement have fallen precipitously. Assuming these monthly reductions are reflected in the next quarterly CPI report, then quarterly CPI inflation may well show a return to the RBA's target 2-3% range. The RBA will be keen to inject some confidence in the run-up to the important Christmas trading period. The most effective way to do this, while obtaining maximum confirmation of the downward inflation trend, is to hold in November but signal intention to reduce in December and then follow-through on this signal. Any reductions will be limited by continued upward pressure on house prices and full employment."

Cameron Murray, Fresh Economic Thinking (Hold): "Australia since COVID has lagged peer nations."

Richard Holden, UNSW (Hold): "Core inflation is homegrown and persistent."

Ask a question