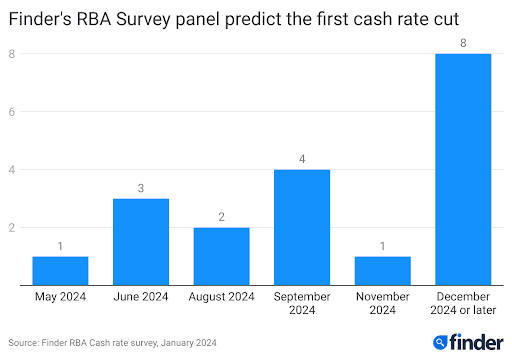

Finder’s RBA Survey: 1 in 3 experts forecast a cash rate cut by August

Aussie homeowners could finally be in for some much-needed relief, following lower-than-expected inflation figures.

In this month's Finder RBA Cash Rate Survey™, 19 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

Almost all experts (89%, 17/19) believe the RBA will hold the cash rate at 4.35% in February.

Graham Cooke, head of consumer research at Finder, said many Australians were in urgent need of reprieve.

"Homeowners are still reeling from 13 rate hikes in the last 2 years. Our data shows a staggering 40% struggled to pay their mortgage in December.

"Even though inflation is falling, I expect the RBA will hold the cash rate for most, if not all of 2024."

While 1 in 3 panellists (6/19) predict a cash rate cut by at least August this year, almost half (40%, 9/19) don't expect the RBA to start cutting rates until December 2024 or later.

Peter Boehm from Pathfinder Consulting said inflation was heading in the right direction.

"In Australia I expect there will be little change [to the cash rate] during the first half of the year (subject to any inflation shocks).

"By mid-year we should see rates come down by at least 50 basis points over the second half of 2024, as inflation heads towards the target range," Boehm said.

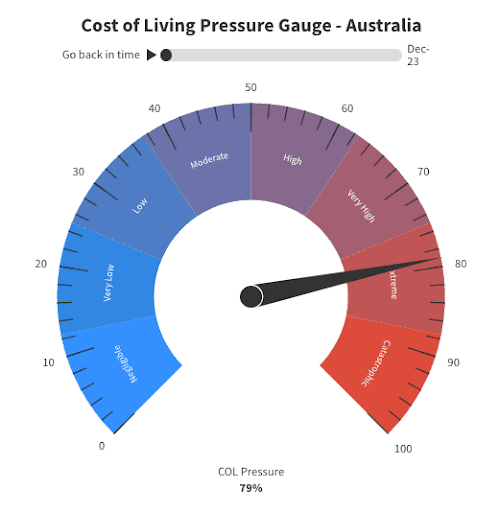

Finder's Cost of Living Pressure Gauge increases to 79%

Finder's Cost of Living Pressure Gauge – which combines data from Finder's Consumer Sentiment Tracker (CST) and the Reserve Bank of Australia (RBA) – assesses the economic strain experienced by Australian households.

The gauge shows that in December 2023, the cost of living pressure experienced by Australian households sat in the extreme range at 79% – an increase of 1 point from the month before;

- Australians report $3,000 lower savings balances compared to the previous month.

- 78% of Australians feel extremely or somewhat stressed about their finances.

- 56% of homeowners and 63% of renters report housing costs are causing financial stress.

- Australian credit card spending reached a record high at $34.6 billion.

The majority of experts who weighed in* (71%, 10/14) expect the cost of living crisis to ease eventually in 2024.

"While the gauge remains in the extreme range, it's likely that this will be where the cost of living pressure peaks.

"We expect to see some relief on the horizon, and with a little luck the pressure will reduce slowly over many months," Cooke said.

Mark Crosby from Monash University noted, "Inflation is continuing to fall, and some staples such as fuel are likely to continue to fall in price."

Australians taking action

Almost 2 in 5 Aussies (37%) – equivalent to 7.5 million people – are doing what they can to alleviate financial pressure.

Finder's survey of 1,063 respondents uncovered the drastic measures some households are taking to overcome affordability difficulties.

The research found 3% of Aussies have resorted to paying for their mortgage on credit card, while 4% have taken out a personal loan to deal with rising housing costs.

Renting out a spare room (5%) and moving in with a friend to share a mortgage (4%) were other common strategies.

1 in 7 Australians have cut back on buy now pay later (BNPL) purchases (14%), while 12% have laid off credit card spending.

Cooke said rising costs had been relentless with everything from rent to insurance to electricity going up in 2023.

"The threat to livelihoods is significant and many people are having to make some tough calls to get by.

"As we wait for interest rates to drop – people are taking matters into their own hands.

"If you haven't reviewed your financial arrangements in the past 12 months, you could probably be getting a better deal," Cooke said.

*Experts are not required to answer every question in the survey

Here's what our experts had to say:

Nick Frappell, ABC Refinery (Increase): "Inflation not yet tamed. The RBA's next action is really hard to call but going to go with one last rise."

Sean Langcake, Oxford Economics Australia (Increase): "The breadth of inflation pressures still warrant tighter policy settings. The Q4 CPI data will be pivotal – an upside surprise to services inflation could trigger one more rate hike."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Hold): "Unless the December quarter CPI presents another unpleasant surprise (as the September quarter CPI did), I think the RBA is "done" tightening. I think they are prepared to tolerate a slower return of inflation to its (higher) target range than its peers, in order to hold on to more of the recent gains in reducing unemployment. That is one reason why it hasn't raised rates as much as its peers: but the quid pro quo surely is that it won't be as quick to start cutting rates as its peers."

James Morley, The University of Sydney (Hold): "There seems to be a shift away internationally from a rate raising cycle as inflation has generally come down faster than expectations. This makes it more likely that the RBA is also done with its raising cycle. However, if services inflation comes in higher than expectations, they may well raise again. Certainly, it looks unlikely that they will start a cutting cycle any time soon. There would need to be a substantial deterioration of the labour market and broader economic conditions. So a cut seems unlikely until late 2024 at the earliest."

Tomasz Wozniak, University of Melbourne (Hold): "Happy New Year! My forecasts hardly contain the current cash rate value within the forecast interval, with most of the forecast density mass indicating downward movements. My reading of these results is that the RBA will HOLD the cash rate at the current value to push the inflation down more. I expect the first interest rate cuts by mid-2024. My forecasts are available at https://forecasting-cash-rate.github.io/."

Peter Boehm, Pathfinder Consulting (Hold): "Inflation appears to be heading in the right direction and it looks as though the US is about to reduce interest rates. In Australia I expect there will be little change during the first half of the year (subject to any inflation shocks) and by mid-year we should see rates come down by at least 50 bp over the second half of 2024, as inflation heads towards the target range."

A/Prof Mark Melatos, School of Economics, University of Sydney (Hold): "Inflation remains significantly above the RBA's target band despite moderating in recent months. There is inconclusive evidence as to the extent of the dampening impact of monetary tightening on consumption. Moreover, house prices appear to have significantly decoupled from incomes and shrugged off the rate increases to date. As long as low unemployment (effectively full employment) persists, the cash rate is unlikely to be reduced and further increases remain a distinct possibility."

Adj Prof Noel Whittaker, QUT Business School (Hold): "Interest rates are easing right around the world – there's no reason to increase them here."

Harry Murphy Cruise, Moody's Analytics (Hold): "While the RBA has broken the back of price pressures, inflation is still a mile away from the central bank's 2.5% target. What's more, service inflation is proving sticky, meaning future improvement might be slow-going. That'll see interest rates stay elevated a while longer, with households and businesses having to wait until the second half of next year until the RBA eases up."

Nicholas Gruen, Lateral Economics (Hold): "We're all guessing, but with inflation slowing, the worry may well swing towards recession."

Stella Huangfu, University of Sydney (Hold): "Reserve Bank has increased cash rate in November 2023, it would be too early to hike the rate again in February 2024, given that inflation has been moderated."

Michael Yardney, Metropole Property Strategists (Hold): "There is evidence that our economy is slowing, local inflation is slowly falling and overseas inflation is coming under control as oil prices fall. There is no reason for another rate rise at present."

Geoffrey Kingston, Macquarie University Business School (Hold): "Same call as last month. That is, the economy is slowing to the extent we are now probably at the top of the rate cycle, to the extent cuts will be needed, in September or thereabouts."

Tim Reardon, Housing Industry Association (Hold): "There were long lags in this cycle. Home building is set to slow significantly in 2024, this will flow through to the wider economy. Also, the global supply shocks that caused the peak in inflation have dissipated."

David Robertson, Bendigo Bank (Hold): "Another RBA hike to 4.6% can't be ruled out entirely but a more likely scenario is no change at all (up or down) in 2024. Economic data will show the economy slowing further suggesting no more hikes, but equally inflation will remain frustratingly above target throughout 2024."

Stephen Halmarick, Commonwealth Bank (Hold): "Rate cuts to start in Sept 2024 as inflation forecasts are consistent with inflation in target."

Cameron Murray, Fresh Economic Thinking (Hold): "Following global trends."

Mark Crosby, Monash University (Hold): "At this stage there is no reason for the RBA to cut for some time yet, and as long as inflation keeps falling the current rate setting would seem appropriate."

Shane Oliver, AMP (Hold): "We expect a combination of falling December inflation data, weak December retail sales and a rising trend in unemployment to head off another rate hike in February. By June enough evidence of weak growth and falling inflation will have accumulated to enable the RBA to start cutting rates."

Ask a question