Finder’s RBA Survey: 1 in 4 experts tip a rate cut before Christmas

Cash-strapped mortgage holders may well be getting an early Christmas gift this year, according to Finder's latest poll.

In this month's Finder RBA Cash Rate Survey™, 36 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

The majority of experts (81%, 29/36) believe the RBA will hold the cash rate at 4.35% in August, however almost 1 in 5 (19%, 7/36) are predicting an increase.

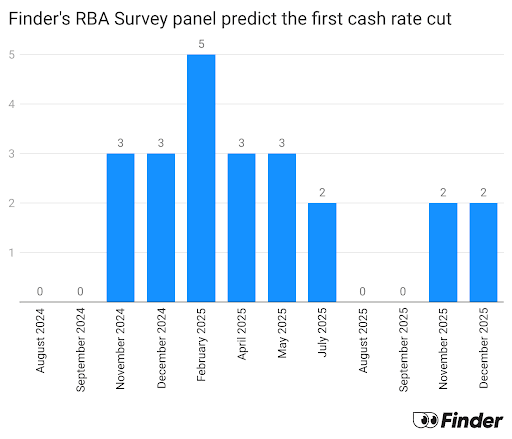

1 in 4 (26%) economists expect to see the first cash rate cut happen by the time the RBA finishes its December meeting.

Graham Cooke, head of consumer research at Finder, said the general consensus is that the latest inflation figures aren't high enough to warrant a rate hike.

"While inflation has been a stubborn thorn in the economy, the June quarter CPI data was in-line with expectations, although still higher than the RBA would like it to be.

"Australia's core inflation rate, which excludes the most volatile products such as food and energy, has slowed enough to almost rule out another rate rise.

"This doesn't mean we will see a rate cut in August, but there is a chance we'll get one by Christmas," Cooke said.

Evgenia Dechter from the University of New South Wales said she isn't anticipating any change to the cash rate this month.

"There is a slowdown in inflation and economic activity, and unemployment is creeping up.

"Although inflation remains persistently above the target, the RBA is likely to hold the cash rate," Dechter said.

James Morley from The University of Sydney disagreed.

"The RBA will raise the cash rate because it will want to demonstrate its primary focus is on bringing inflation back down to the target range."

Despite predicting the hike now, Morley says he can also see a quick cut afterwards.

"A further weakening of economic conditions and improvements in inflation measures for Q3 will allow the RBA to consider reversing the rate rise in December and continue cutting in the new year to bring the cash rate back towards a neutral level," Morley said.

Record high 2 in 5 mortgage holders struggling to pay their home loan

A whopping 41% of homeowners struggled to pay their mortgage in July, up from 34% in June, according to Finder's Consumer Sentiment Tracker.

Graham Cooke said mortgage stress was widespread across the country.

"The number of Australians who are struggling to afford their monthly mortgage repayments has been steadily trending upwards since 2021.

"Millions of homeowners are desperate for relief with borrowers anxiously waiting for rates to start dropping," Cooke said.

Economic sentiment drops to a record low

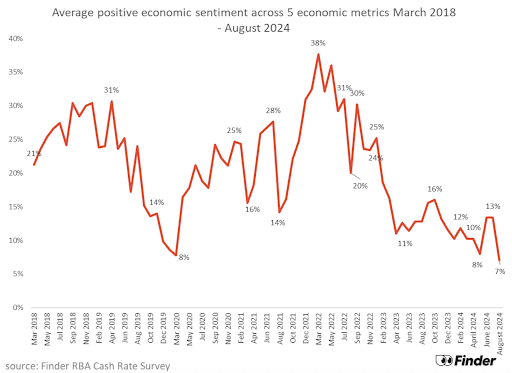

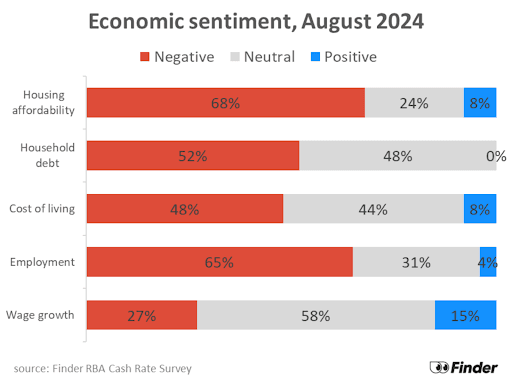

Finder's Economic Sentiment Tracker gauges experts' confidence in 5 key indicators over the upcoming 6 months: housing affordability, employment, wage growth, cost of living and household debt.

Average positive economic sentiment has dropped to a record low of 7% in August, surpassing the previous low of 8% in March 2020, when pandemic fears ran wild.

Household debt continues to be a problem, with 52% of experts expressing a negative outlook. Not one expert (0%) sees a positive trend in household debt.

The sentiment towards cost of living is largely negative, with 48% of experts expressing concern. Just 8% of panellists see any positivity in the next 6 months towards the cost of living.

Cooke said many households simply weren't keeping up with rising costs.

"Millions of Aussies feel like they're going backwards financially with many in deficit.

"People's ability to save is deteriorating as more of their paychecks are sucked up by mounting interest rates and inflation."

Cooke encouraged Aussies to look for any ways to stretch their dollar further.

"Tough times often spur people into action with thousands giving their finances a shake down.

"Finder's Financial Fitness Challenge is doing just that – it's designed to help households fight back against the rising cost of living.

"Completing the challenge could potentially save the average renter $3,810 over a year, while the average homeowner could put a whopping $13,722 back in their pockets," Cooke said.

*Experts are not required to answer every question in the survey

Here's what our experts had to say:

Nalini Prasad, UNSW Sydney (Increase): "The latest release of data shows that inflation remains higher than target. I think the RBA will want to increase interest rates to try and bring down inflation rather than risk not doing anything and seeing inflation rise in the future."

Stella Huangfu, University of Sydney (Increase): "Australia's annual inflation rate has risen to 3.8%, up from 3.6% earlier this year. The ABS reported a 1% price increase in both the June and March quarters. This marks the first rise in annual CPI inflation since December 2022. It's likely the RBA will raise interest rates at their August 6 meeting to address these inflationary pressures."

Dale Gillham, Wealth Within (Increase): "Once again core inflation is up slightly on the previous period and so I think the RBA has no choice but to raise rates by 25 basis points."

James Morley, The University of Sydney (Increase): "The RBA will raise the cash rate because it will want to demonstrate its primary focus is on bringing inflation back down to the target range. The reversal of year-ended inflation back up to 3.8% from 3.6% in Q1 means that it makes sense for the RBA to raise the cash rate by 25 basis points. While headline inflation is expected to fall again in Q3, the persistence of underlying measures above the target range and an increase in services inflation motivate a tightening to keep the RBA's medium term forecasts consistent with inflation falling back to the target range as originally planned. However, I think that a further weakening of economic conditions and improvements in inflation measures for Q3 will allow the RBA to consider reversing the rate rise in December and continue cutting in the new year to bring the cash rate back towards a neutral level."

Nicholas Frappell, ABC Refinery (Increase): "Inflation is stubborn, and there are hints that the RBA is alert to the risk of inflation expectations de-anchoring, and the future cost that would entail to fight a change in expectations."

Jakob Madsen, University of Western Australia (Increase): "Inflation is still running high and the RBA cash rate is below that of the UK and the US."

Richard Holden, UNSW (Increase): "I expect the June quarter CPI figures to be alarming."

Nicholas Gruen, Lateral Economics (Hold): "It won't hike this time because the trend inflation numbers have continued to fall towards the target area."

Anthony Waldron, Mortgage Choice (Hold): "I expect the Reserve Bank will keep the cash rate on hold in August. The ABS June quarter Consumer Price Index revealed annual trimmed inflation has trended down for the sixth quarter in a row, indicating that the current cash rate is having the desired impact."

Shane Oliver, AMP (Hold): "Inflation rose in the June quarter but it was in line with RBA's own forecasts heading off the need for another rate hike. At the same time inflation is still too high and the RBA still lacks confidence that it will sustainably head back to target so it's too early to expect a cut."

Malcolm Wood, Ord Minnett (Hold): "Inflation remains sticky and well above target. Large fiscal stimulus impacting now will only intensify underlying inflationary pressures."

Evgenia Dechter, University of New South Wales (Hold): "There is a slowdown in inflation and economic activity, and unemployment is creeping up. Although inflation remains persistently above the target, the RBA is likely to hold the cash rate."

Mark Crosby, Crosby (Hold): "Almost enough to increase rates, but general economic weakness enough to warrant holding a bit longer."

Kyle Rodda, Capital.com (Hold): "Inflation is tracking only slightly above the RBA's latest projections, suggesting the central bank has more time to assess whether current policy settings are appropriate to get inflation back within the target band."

Brian Parker, Australian Retirement Trust (Hold): "Latest inflation news wasn't brilliant but not bad enough to warrant a rate hike in August."

Tomasz Wozniak, University of Melbourne (Hold): "We are at a crossroads! Given that the pooled forecast from my system indicates a 70 per cent chance of a RAISE, there has never been such a discrepancy in the forecasts from particular models. Bond yield curve models reflecting market expectations indicate a RAISE by 10 bp. Global interest rate models follow other markets and indicate a CUT. Univariate models reflecting persistence settle at HOLD. It's true to write that the RBA should increase the cash rate, but they will probably not. You can access these forecasts at https://forecasting-cash-rate.github.io/"

Matthew Greenwood-Nimmo, University of Melbourne (Hold): "Inflation is in-line with expectations, and the RBA is likely to hold the cash rate steady in August."

Sean Langcake, Oxford Economics Australia (Hold): "The Q2 CPI print provided enough evidence that inflation is still on a path to the RBA's target for them to keep rates on hold. Headline inflation is in line with the RBA's forecasts. Beyond this, tradables surprised to the upside, but this strength will likely be transitory. Encouragingly, non-tradable categories outside of housing saw an easing in inflation pressures - showing that tight policy is working to rein in demand."

Stephen Halmarick, Commonwealth Bank (Hold): "Inflation heading back into target and global monetary policy easing."

Cameron Kusher, REA Group (Hold): "It's clear that inflation is largely heading in the direction the RBA is forecasting after the latest CPI data was published. There seems no reason for the RBA to lift or reduce interest rates at this stage."

Geoffrey Kingston, Macquarie University Business School (Hold): "The July data on inflation came in at or below expectations. So the Bank will probably hold rather than hike. According to legend, Napoleon wanted his generals to be lucky rather than skilful. Michele Bullock could be Jim Chalmers' lucky general."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Hold): "The June quarter numbers showed an uptick in 'headline' inflation and a marginal decline in 'underlying' inflation .. the latter was marginally, rather than 'materially', above the RBA's forecast, so although there's a legitimate case for raising rates, I don't think it's strong enough to prompt them to overturn the choice they have previously made to 'tolerate' inflation being above their target for longer than their peers, in order to minimise the impact of the struggle to contain inflation on unemployment and under-employment."

David Robertson, Bendigo Bank (Hold): "The latest CPI data confirms that core inflation is still moderating but at a frustratingly slow pace, meaning the RBA will maintain the cash rate at its current restrictive level for the balance of 2024. We still expect cuts next year, most likely starting in May."

Michael Yardney, Metropole (Hold): "Inflation has lifted to 3.8 per cent in the year to June, from 3.6 per cent in March, being the first increase in 18 months. While this is a concern, a more positive sign is that the RBA's preferred measure of underlying inflation - which removes more volatile price movements - dropped to 3.9 in the year to June, from 4 per cent in March. The RBA is likely to keep interest rates on hold this meeting and wait for further data as headline inflation is likely to drop sharply over the second half of this year as billions of dollars in state and federal government electricity rebates lower power bills."

Stephen Miller, GSFM (Hold): "Inflation is likely to decline in a grudging fashion. Inflation seems "stickier" in Australia than elsewhere, probably reflecting the RBA's cautious approach (compared to peers) in raising the policy rate."

Garry Barrett, University of Sydney (Hold): "Latest CPI data, especially underlying measures, for quarter indicate inflationary pressure is easing."

Leanne Pilkington, Laing+Simmons (Hold): "Leaving rates unchanged is the right move. Inflation is heading in the right direction, albeit gradually, and many mortgage holders are already on the brink."

Jeffrey Sheen, Macquarie university (Hold): "Economic growth remains weak. It will take more time for inflation to finally reach the RBA's target range. There is no need for a change in the cash rate now. By November, I expect the RBA to be ready to cut."

Mala Raghavan, University of Tasmania (Hold): "Due to inflation."

Adj Prof Noel Whittaker, QUT (Hold): "Our inflation is embedded, but there is so much hurt going on but I don't think the Reserve. Bank will be raising rates for a while. Both state and federal governments are on spending sprees."

Mathew Tiller, LJ Hooker Group (Hold): "Signs of softening employment markets and inflation falling significantly from its peak of 7.8% in December 2022, should see the RBA hold rates steady for the remainder of the year."

Devika Shivadekar, RSM Australia (Hold): "The August meeting would be a very close call."

Associate Professor Mark Melatos, School of Economics, University of Sydney (Hold): "Inflation remains above the RBA's target band despite moderating in recent months. House prices appear to have significantly decoupled from incomes and shrugged off the rate increases to date. As long as low unemployment (effectively full employment) persists, the cash rate is unlikely to be reduced and further increases remain a possibility."

Tim Nelson, Griffith University (Hold): "No significant changes in economic conditions."

Peter Munckton, Bank of Queensland (Hold): "The economy is slowing. But it will not until the H1 2035 that it will be clear that inflation has declined enough to allow for a rate cut."

Cameron Murray, Fresh Economic Thinking (Hold): "Although there is a slow down happening in the economy, the cycle is slower than many expect, and there is usually a late stage surprise surge. So any decline in rates must wait for this process to play out."

Ask a question