Finder’s RBA survey: Over $1,000 added to average monthly mortgage since April

Australian homeowners have been hit with a 10th consecutive cash rate hike from the RBA.

In this month's Finder RBA Cash Rate Survey™, 42 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

Almost all panellists (93%, 39/42) correctly predicted a cash rate rise in March, with the majority (86%, 36/42) accurately forecasting the increase of 25 basis points – bringing it to 3.60%.

Graham Cooke, head of consumer research at Finder, said it was bad news for homeowners already doing it tough.

"Australians with the average loan size of around $600K will be forking out over $13,000 more per year on their mortgage compared to what they were paying a year ago.

"While homeowners deserve a break from the relentless increase in pressure, we can expect ever more hikes from the RBA this year," Cooke said.

The panel now forecast that the cash rate will peak on average at 4.10%, with almost 4 in 5 who weighed in* (78%, 28/36) saying it will peak in the first half of 2023.

Average Aussie mortgage repayments

| Cash rate | Average home loan rate* | Average monthly repayment | Average monthly increase | Average annual repayment | Average annual increase | |

|---|---|---|---|---|---|---|

| Apr-22 | 0.10% | 3.45% | $2,697 | - | $32,364 | - |

| Mar-23 | 3.60% | 6.47% | $3,808 | $1,111 | $45,696 | $13,332 |

| (full rate rise applied) | ||||||

| 4.10% (predicted peak) | 4.10% | 6.97% | $4,009 | $1,312 | $48,108 | $15,744 |

Source: Finder, RBA. *Owner-occupier variable discounted rate. Repayments based on the average loan of $604,346 (ABS data analysed by Finder).

A whopping 36% of Aussie homeowners said they struggled to pay their mortgage in February, according to Finder's Consumer Sentiment Tracker.

Welcome news for Aussies: Cost of living has likely peaked

CPI inflation reached 7.8% in December 2022, and the employees' Selected Living Cost Index (SLCI) reached 9.3%.

As such, almost 3 in 4 experts (73%, 27/37) believe the general rise in the cost of living has peaked.

Cooke said inflation reaching its peak is the first ray of sunshine from Finder's survey since the pre-COVID era.

"If inflationary pressures subside in late 2023, we may start to see a lower cash rate and lower repayment costs for borrowers – but it will not reduce as fast as it increased," he said.

Shane Oliver from AMP said inflation in several major countries including the US appears to have peaked and is leading Australia by around 6 months.

"Supply shortages are fading, freight costs have fallen, many commodity prices (including for energy) are off their highs, business surveys report slowing input and output prices and falling order backlogs and delivery times and demand is likely to slow."

Mark Crosby from Monash University agreed, noting "Already indications that inflation is falling in most peer economies, and energy and supply chain pressures appear to be lessening."

However the panel does not think inflation will go away quickly in 2023. The majority of experts (80%, 28/35) do not believe the quarter-on-quarter price rises will return to the pre-pandemic average of 0.5% in 2023.

Pressure is building for Aussie renters

The number of new housing loans for owner-occupiers and investors fell 30% and 27% respectively, in December 2022 versus December 2021, according to ABS data.

More than 2 in 3 experts (68%, 19/28) believe this will put even more pressure on rental prices, as more people stay renting rather than buy a home.

Cooke said we've seen mortgage costs go up faster than rental costs.

"This could mean there is a lag yet to hit the already heated rental market," he said.

Mala Raghavan from the University of Tasmania said there is currently a limited supply of rental properties with a low vacancy rate in the market.

"With fewer Australians buying homes, coupled with the inflow of international students and foreign workers, the demand for rental properties will increase, putting significant pressure on landlords to increase rental prices," Raghavan said.

Almost half of Aussie renters (43%) said they struggled to pay their rent in February, according to Finder's Consumer Sentiment Tracker.

1 in 2 experts negative about employment

Retail turnover fell 3.9% month on month in December 2022, the first drop since December 2021.

The majority of experts (81%, 25/31) say these figures indicate that retail businesses will start to cut staff and hiring over the next 6 months.

Tina Teng from CMC Markets noted, "The RBA's rate hikes and elevated inflation will weaken consumption further, leading to headcount cuts in retailers."

Nalini Prasad from UNSW Sydney said despite the uptick in unemployment in the most recent data, the labour market is still tight.

"It's hard to imagine the unemployment rate being able to fall much further than where it was in late 2022. Higher interest rates and inflation are likely to weigh on consumer spending," Prasad said.

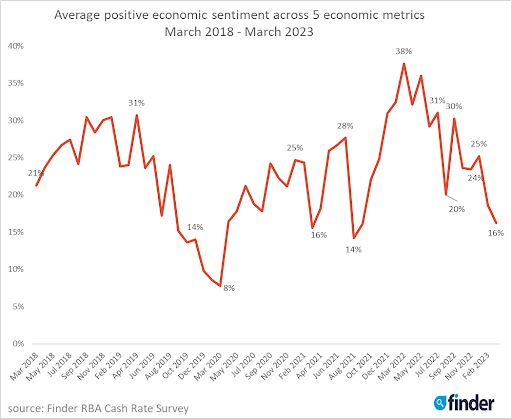

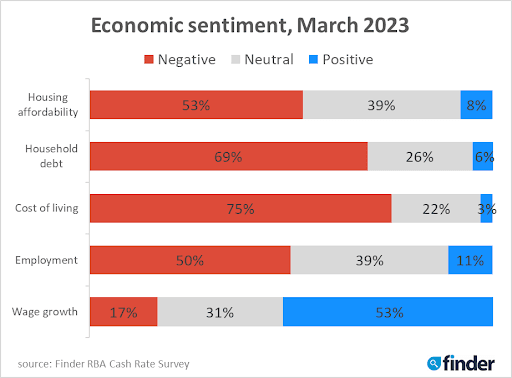

Finder's Economic Sentiment Tracker gauges experts' confidence in 5 key indicators: housing affordability, employment, wage growth, cost of living and household debt.

Cooke said March was the lowest average result for economic sentiment we have seen over many months.

"It seems economists and property experts alike agree we are living in uncertain times."

Negativity towards employment doubled from 25% in February to 50% in March, while negativity towards housing affordability jumped from 39% to 53% respectively.

*Experts are not required to answer every question in the survey

Here's what our experts had to say:

Stella Huangfu, University of Sydney (Hold): "After nine consecutive cash rate increases, it is time for the RBA to wait and see before they take any further actions. There is strong evidence that the economy has been slowing down already. Unemployment rate starts picking up."

Evgenia Dechter, UNSW (Hold): "The RBA decision will depend on the current economic indicators. The wage growth data was below expectations. If the monthly CPI will also fall short of expectations, the RBA may choose to hold the cash rate in March."

Tim Nelson, Griffith University (Hold): "The RBA may wait to see the next set of inflation figures before increasing rates again."

Matthew Greenwood-Nimmo, University of Melbourne (Increase): "Inflation is unacceptably high and the RBA will be wary of it becoming entrenched. Higher interest rates will help to manage inflation and keep inflation expectations anchored at appropriate levels."

Tim Reardon, HIA (Increase): "Their past statements."

Tomasz Wozniak, University of Melbourne (Increase): "My predictive systems for monthly and quarterly data unequivocally indicate further increases in the value of the cash rate by around 18 basis points in March. Moreover, the cash rate will likely increase to about 3.7 or 3.9% by June 2023. However, after that period, the forecasts give contradictory conclusions. Therefore, the arrival of new data will play a decisive role in shaping expectations for the year's second half. My projections are available at https://donotdespair.github.io/cash-rate-survey-forecasts/"

Shane Oliver, AMP (Increase): "The RBA has indicated repeatedly over the last few weeks that it expects to increase interest further as inflation remains too high."

Anthony Waldron, Mortgage Choice (Increase): "I expect the Reserve Bank to raise the cash rate in March in its continued effort to contain inflation, however we are likely nearing the end of this rate rise cycle."

Andrew Wilson, My Housing Market (Increase): "9 consecutive rate increases have clearly failed to impact still record-high inflation. The RBA has nowhere left to go with rates other than up to follow its policy mandate."

Peter Munckton, Bank of Queensland (Increase): "The economy is in decent shape and inflation is too high. The RBA has also made it clear there are more rate hikes to come."

Nicholas Gruen, Lateral Economics (Increase): "It will lift because it is worried about inflation becoming entrenched. However it looks like inflation could come down quite sharply soon given how little has fed into wages so I think it would make more sense to wait this month."

Leanne Pilkington, Laing+Simmons (Increase): "Despite all the elevated scrutiny of the RBA's processes recently, the scene appears set for more rate rises to follow, and with them more pain for people."

Mark Crosby, Monash University (Increase): "RBA still indicating more to do to bring inflation under control, so likely to raise at least twice more before next inflation read tells a tale for the next few months."

Nalini Prasad, UNSW Sydney (Increase): "Underlying measures of inflation are strong. This will likely cause the RBA to lift interest rates until they see some easing in inflation numbers. Interest rates are likely to increase in the near term but by the middle of the year previous increases in interest rates are more likely to be felt in the economy. Wage growth for example, remains subdued despite a tight labour market."

Craig Emerson, Emerson Economics (Increase): "The RBA seems hellbent on engineering a recession."

James Morley, The University of Sydney (Increase): "The path of rates depends very much on inflation numbers. The RBA has signalled that it will keep increasing rates based on current projections of inflation. If the Q1 number this week comes in high, it seems guaranteed the RBA will raise until they get a lower number for Q2. Even if the Q1 number is lower than expectations, I believe they will raise rates this round and possibly in April and May until they see other data (like monthly CPI) confirming an easing of inflation."

Brodie Haupt, WLTH (Increase): "It is almost certain the Reserve Bank will continue to increase the cash rate until the inflation begins to abate."

Tina Teng, CMC Markets (Increase): "The RBA will likely keep raising interest rates until inflation returns to the 2–3% target level."

Jonathan Chancellor, The Daily Telegraph (Increase): "It seems the RBA aim of getting inflation down will require another rate rise, and the sooner the better."

Garry Barrett, University of Sydney (Increase): "Continuing high CPI."

Noel Whittaker, Queensland University of Technology (Increase): "They have made no secret of the fact they will keep on increasing rates until the inflation target is reached."

Angela Jackson, Impact Economics and Policy (Increase): "While there is a case for the RBA to hold rates and allow the tightening from 2022 and last month to take effect, their communications indicate they will not hold until they see concrete evidence that the tightening is working."

Alan Oster, NAB (Increase): "Consumers are still robust and inflation taking too long to get back into the target range."

Mathew Tiller, LJ Hooker Group (Increase): "Despite early signs that inflation has begun to ease, it remains very high."

Rich Harvey, Propertybuyer (Increase): "Very clear determination by the RBA that inflation needs to be reduced and they indicated more rises to come. Cost of living pressures are hurting consumers, but this needs to be balanced with inflation eroding purchasing power."

Mala Raghavan, University of Tasmania (Increase): "Considering that inflation is stubbornly high, the RBA is expected to tighten the monetary policy in March, and these tightening measures could continue till May. Though inflation pressures are easing in retail, recreation and hospitality industries, other sectors like constructions/housing/rentals, fuel and transport costs and food and non-alcoholic beverages, the inflation pressure is expected to persist for a while depending on the uncertain global economic and political environment. The labour market pressure is also likely to ease in some sectors due to the return of international students and foreign workers. In contrast, in other sectors, the labour shortages are still acute, putting pressure on wage costs."

A/Prof Mark Melatos, School of Economics, University of Sydney (Increase): "Inflation, especially the trimmed mean of the CPI, remains significantly above the RBA's target band. The RBA is still in catch-up mode with respect to matching their cash rate settings to the inflation reality."

David Robertson, Bendigo Bank (Increase): "The RBA are close to a pause in rate hikes but appear almost certain to hike 25 basis points in March, before one more hike around May. By then there will be more evidence that inflation has peaked and will slowly but steadily decelerate through the year."

Dale Gillham, Wealth Within (Increase): "The RBA has made it quite clear they have more rate rises in store. Whilst there are some signs that CPI growth is slowing they are not enough to stem further interest rate rises."

Jeffrey Sheen, Macquarie University (Increase): "To ensure that inflation expectations continue to fall."

Peter Boehm, Director (Increase): "The RBA has made it pretty clear it intends to increase rates until inflation falls, regardless of the negative impacts further interest rate rises will have on Australian families."

Harry Murphy Cruise, Moody's Analytics (Increase): "Inflation remains bitingly high, forcing the RBA to keep hiking interest rates. While the worst of the inflation pressures are likely in the rear-view mirror, a meaningful price reprieve is still some time away. As such, we expect consecutive rate hikes at the next two meetings, taking the cash rate to 3.85%. In better news, earlier rate hikes are starting to have an effect: unemployment is lifting, retail sales volumes went backwards in the December quarter and wage rises have been lower than feared. This should keep interest rates under 4%."

Stephen Halmarick, Commonwealth Bank (Increase): "RBA rhetoric."

Geoffrey Kingston, Macquarie Business School (Increase): "Continuing heat in the labour market plus continuing fiscal expansion will necessitate further rises."

Jakob Madsen, University of Western Australia (Increase): "Inertia in inflation. The real interest rate is still negative which is not sustainable and makes little economic sense since it is savings that drive economic progress – not consumption."

Jason Azzopardi, Resimac (Increase): "Rate rises to continue before RBA start to believe tipping point reached of taming inflation vs sending economy backwards."

Nicholas Frappell, ABC Refinery (Increase): "The RBA is responding to 'high and broad-based inflation' and a fairly tight labour market."

Stephen Miller, GSFM (Increase): "The RBA has been tardy in recognising the magnitude and momentum of inflation and needs to take timely remedial action."

Sean Langcake, BIS Oxford Economics (Increase): "The RBA have made it abundantly clear that they have not yet finished raising rates. Inflation remains very high, and the RBA is intent on avoiding a 'price-wage' spiral where inflation expectations drift upwards and high inflation becomes entrenched. There are few signs this is underway, and by the governor's admission this is a low probability possibility – but a very high cost one. We expect the RBA will hike through to May. By that time, data on the real economy will be patchy, warranting a pause in the rate hiking cycle."

Christine Williams, Smarter Property Investing Pty Ltd (Increase): "Unfortunately the RBA's formula is out of date, compared to our unemployment at only 3.7% and they are using unemployment as the key factor. They are concerned at the saved monies during COVID, that is now being spent. Therefore my view is the formula is incorrect."

Michael Yardney, Metropole Property Strategists (Increase): "RBA governor Philip Lowe is hell bent on getting inflation under control and has signalled a few more interest rate rises."

Cameron Kusher, REA Group (Increase): "RBA has made it very clear that interest rates need to rise further due to heightened inflation so I expect further increases."

Ask a question