Home loan hangover: Refinancing booms to defend against mortgage pain

Mortgage holders are reeling from 3 consecutive cash rate rises as refinancing hits record highs, according to new research by Finder.

Australia's Big Four banks have all increased their variable home loan interest rates by 50 basis points since the Reserve Bank of Australia's (RBA) cash rate announcement on Tuesday.

A Finder survey of homeowners from July 2022 reveals that almost 1 in 5 Australian mortgage holders (18%) have refinanced their home loan in the past 6 months. The same proportion (18%) say they plan to do so in the coming 6 months.

The total value of refinanced loans reached a record high $19 billion in May – an increase of 20% over the year, according to Finder analysis of the latest Australian Bureau of Statistics (ABS) data released this week.

Sarah Megginson, senior editor of money at Finder, said it was too late to fix a home loan with most fixed interest rates above 5%.

"For some, it's a case of refinance or default on their debt.

"Households are in a very precarious position right now struggling with the worst cost of living crisis in decades."

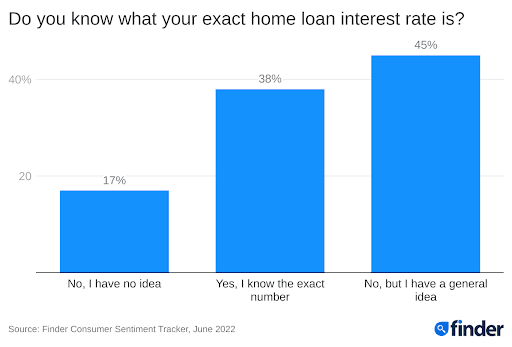

Worryingly, 17% of mortgage holders "have no idea" what their home loan interest rate is.

A further 45% only have a general idea what interest rate they are paying.

Megginson said interest rate increases usually came with a 30-day grace period – giving mortgage holders time to assess their options.

"There's still a lot of competition in the home loan market and you could save hundreds every month by moving to a lender with a cheaper rate.

"Refinancing your home loan could be your saving grace."

The average home loan in Australia in April was $615,304, according to ABS data.

The average homeowner who isn't on a fixed rate will see their monthly repayments jump by $424 compared to what they were paying in April this year.

That's a staggering $5,088 more per year.

Megginson urged Aussies to shop around for more competitive interest rates with smaller lenders offering some of the cheapest rates.

"There's not likely to be any reprieve for the next couple of years.

"Homeowners need to take action immediately if they don't think they will be able to meet their mortgage repayments.

"If you're in financial trouble and you think you'll struggle making repayments at these higher amounts, contact your bank – you might be eligible for a repayment holiday, an interest-only period or a hardship repayment plan," Megginson said.

Looking for a better home loan deal? Check out some of Finder's top home loan picks.

Ask a question