SEC crackdown on Binance, Kraken – What it means for Aussie investors

It's been a busy day for US regulators as Binance faces a US 4$ billion fine and Kraken gets sued by the SEC.

Bloomberg is reporting that the US Department of Justice (DoJ) is asking Binance to pay US $4 billion in order to settle ongoing charges against the exchange and its founder, Changpeng Zhao (CZ).

The charges against Binance are substantial – they accuse the exchange of criminal activities including fraud, the illegal sale of securities and offering unlicensed investment products.

CZ was named in a number of the accusations, and is facing an individual charge of moving assets out of Binance and into third-party companies, reminiscent of the actions of Sam-Bankman Fried (SBF) and the events that led to the collapse of FTX.

It's important to note that these are criminal charges, which means that CZ could face jail time in the US if found guilty.

The reporting mentions that there is still the possibility that CZ could face criminal charges despite the high cost of the settlement.

Markets were unphased by the news, with Bitcoin remaining flat and the overall market up by 1% in the past 24 hours.

BNB – Binance's own token – experienced a sharp rally of 7% on the news, which may be spurred by optimism that Binance's worst days are now behind it.

Kraken sued by the SEC (again)

The US Securities and Exchange Comission has sued Kraken for operating as an unregistered securities exchange, broker, dealer and clearing agency.

The SEC alleges that the Kraken cryptocurrency exchange has violated the law for enabling the trading of cryptocurrencies, without a securities license.

The lawsuit hinges on the assumption that certain cryptocurrencies qualify as securities, which has been a hot topic between regulators and the crypto industry in the US.

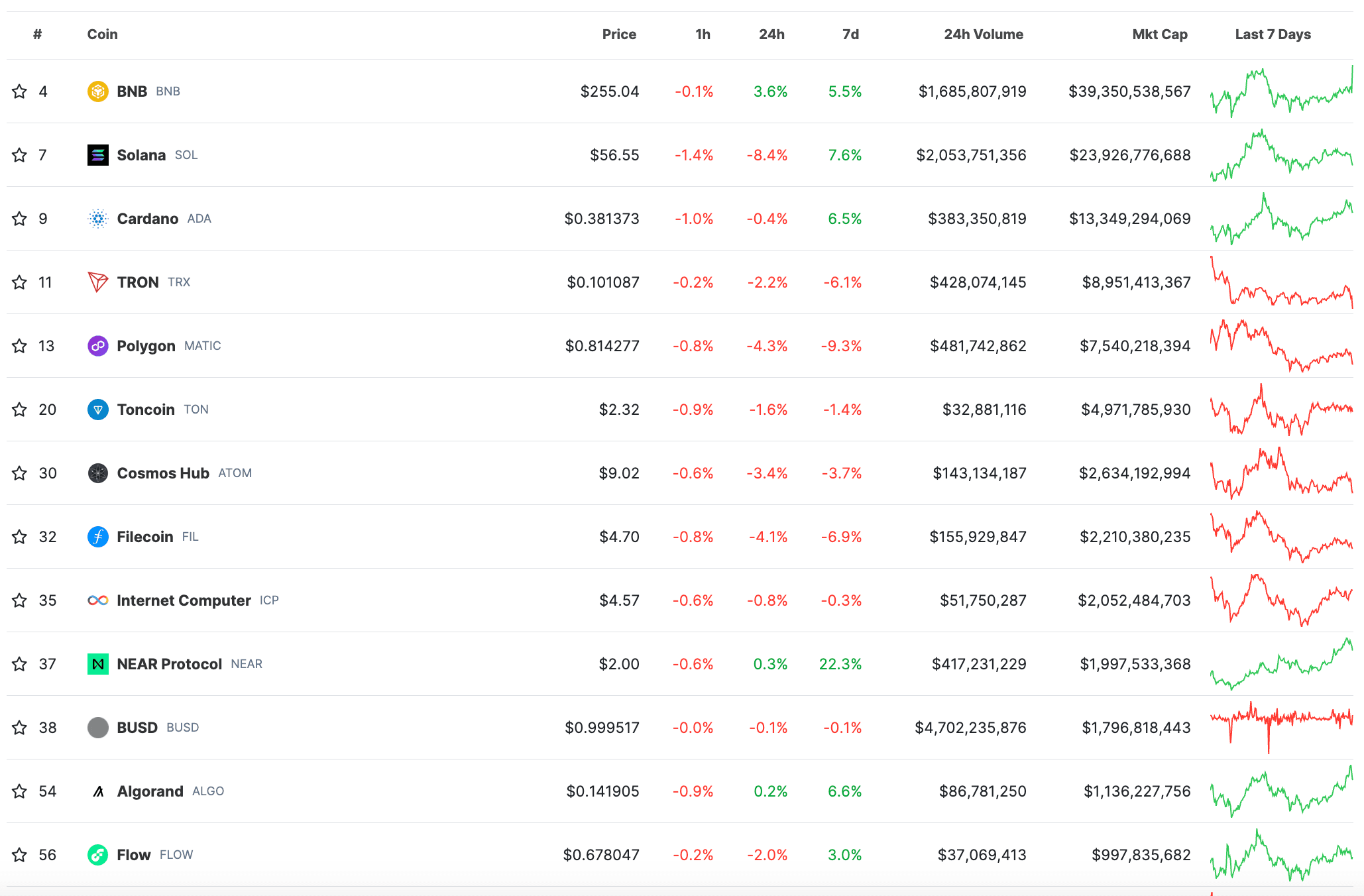

In particular, the suite names the following cryptocurrencies as securities: ADA, AXS, ALGO, ATOM, CHZ, COTI, DASH, FIL, FLOW, ICP, MANA, MATIC, NEAR, OMG, SAND and SOL.

Leading cryptocurrencies that have been labelled as securities by the SEC in various lawsuits.

This is similar to the ongoing case against Coinbase, in which the SEC alleged a similar basket of cryptocurrencies qualified as securities.

Both Kraken and Coinbase argue they have been cooperative with the SEC and have been seeking regulatory clarity for years.

Kraken has issued a statement saying that they "disagree with their claims" and will "vigrously defend our position".

Kraken points to the SECs recent lawsuit against Ripple, in which the SEC lost, as precedence that the law is "on our side".

The statement is optimistic that bipartisan actions in the US Congress will soon bring regulatory clarity to the industry and counter the SECs ongoing "regulation via enforcement approach" which Kraken alleges is politically motivated.

What does this mean for Australian users of Binance and Kraken?

This year Binance, Kraken and Coinbase have all been the subject of various lawsuits by the SEC.

So far, this has not impacted their local operations, given that US and Australian markets are different.

For instance, when Kraken closed its staking operations in the US in response to charges from the SEC, it continued to offer the service to Australians.

However, it's important to note that Binance saw approximately $8 billion of outflows in June when the DOJ charges were first presented.

Given that the SEC alleges that Binance has comingled user assets between countries, any further mass withdrawals could impact the liquidity of Australian users.

Furthermore, Australian exchanges are set to face new regulations which include obtaining an Australian Financial Services License (AFSL).

An AFSL is required by most financial service providers in Australia, including share trading platforms.

Share trading platforms offer securities, which means that obtaining an AFSL will require compliance with Australian securities laws.

Given the charges in the US revolve around the illegal offering of securities, local operators may begin to take a more conservative approach with any product offerings in Australia that could potentially upset regulators and threaten their eligibility to obtain an AFSL.

Join the crypto conversation – Follow us on X now

Trying to get a handle on the markets? Cut through the noise with our overview of the best cryptos to buy right now, explore some strategies for how to trade crypto or see if there's a better platform for you with our guide to the best crypto exchanges.

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Disclosure: The author owns a range of cryptocurrencies at the time of writing.

Ask a question