Binance sued by the SEC: What it means for Australian users

We unpack what the charges against Binance in the USA means for investors in Australia

This morning the United States Securities and Exchange Commission (SEC) charged Binance and its founder, Changpeng Zhao (CZ), with 13 securities law violations.

The charges are leveled at Binance Holdings Limited (Binance's global entity), Binance US (Binance's US company) and a number of other entities owned and operated by Binance and CZ.

The charges are broad in scope and include allegations of fraud, the illegal sale of securities, offering unlicensed investment products and an allegation that CZ himself moved user assets off Binance and into third-party companies – reminiscent of FTX and Sam-Bankman Fried (SBF).

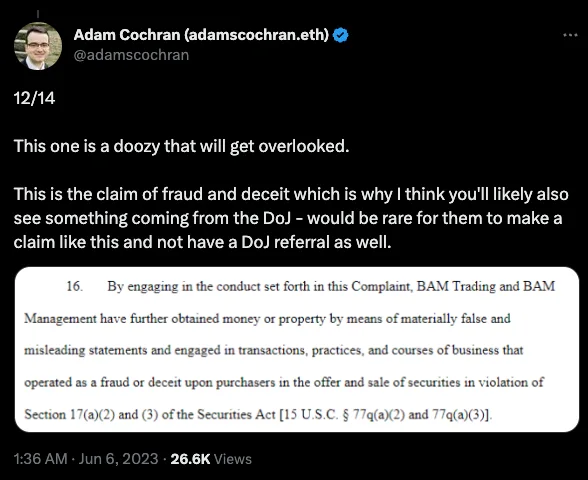

One prominent cryptocurrency expert, Adam Cochran, suspects that legal action from the US Department of Justice (DoJ) may also follow in relation to allegations of fraud.

Binance is the largest cryptocurrency exchange in the world, with trading volume that is frequently larger than that of all competitor exchanges combined.

Despite this, the market has had a fairly subdued response to the news.

At the time of writing, the overall market capitalization of cryptocurrencies is only down by 3.6%, 12 hours after the news first broke.

Bitcoin (BTC) is down 3.9%, Ethereum (ETH) 2.8% and Binance Coin (BNB) 11.1%. Of the top 100 cryptos by market cap, only 7 are showing double-digit losses of between 10-15%.

Given the historic volatility of cryptocurrency markets, an overall decline of 3.9% is insignificant and could otherwise be mistaken for a normal day in crypto markets.

Following the collapse of crypto-lender Celsius in June 2022, the overall crypto market fell by approximately 13% in a single 24-hour period. Likewise, the events of FTX were followed by several days of double-digit losses.

What does it mean for Binance users in Australia?

The short answer is; probably not much in the near term.

According to Michael Bacina, Partner at Piper Alderman and Chair of Blockchain Australia "US court decisions are not binding in Australia" which means we shouldn't expect any rulings made there to transfer here.

The longer answer is; some things will probably change in the long term, but it will depend on the outcome of any legal action, court cases or settlement between the SEC and Binance.

The SEC charges focus largely on Binance's US operations, and how the allegations affect US users. The SEC does not have jurisdiction in Australia.

Binance is just one of several crypto exchanges that have been targeted by the SEC in recent years, with many spectators accusing the SEC of waging a war on crypto.

Previous cases have typically resulted in a settlement between the SEC and the exchange, typically requiring the exchange to pay a fine and stop offering certain services to US customers.

Earlier this year the US exchange Kraken, which also operates locally in Australia, agreed to pay a US$30 million fine after the SEC alleged its staking-as-a-service programme constituted an illegal securities offering.

In addition to the fine, Kraken immediately ended its staking service for US customers.

Australian users on the other hand can still access staking products on Kraken as normal.

More recently in May, global exchange Bittrex agreed to pay a $29 million fine to the SEC for operating an unregistered broker. In response Bittrex chose to exit the US market by filing for bankruptcy, however its global operations have continued as normal.

So based on previous cases against crypto exchanges, it seems most likely that US customers will be severely impacted by any outcome between the SEC and Binance, but foreign users of the platform will not.

However, it is still highly likely that lawmakers in Australia will be following the case closely, in case evidence reveals breaches of Australian laws or harm to Aussie users.

This could result in legal action against Binance Australia, or simply prompt Binance to change its product offering in Australia to help protect against potential regulatory blowback.

As for the latter, Binance Australia voluntarily requested the cancellation of its derivatives license earlier this year. Derivatives products are highly regulated in Australia and treated differently to the normal buying and selling of cryptocurrencies.

Should I get my funds off Binance Australia?

This is ultimately up to you.

When it comes to storing your crypto, best practices generally promote self-custody.

Self-custody refers to holding your crypto in a non-custodial wallet that only you own the private keys to.

You can read more about it in our dedicated guide.

Alternatively, you can move your assets to another exchange with similar coins and features to Binance.

Is this another FTX?

No, not currently.

Sam Bankman-Fried diverted user funds from FTX to his trading firm, Alameda Research. Alameda then gambled with these funds and lost them.

FTX then engaged in multi-billion dollar fraud in an attempt to hide the losses, before being caught out by none other than CZ, the founder of Binance.

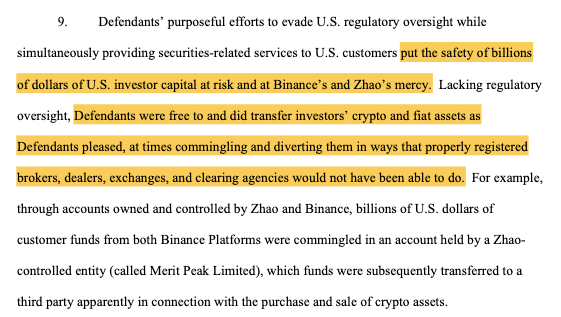

Mind you, one of the SEC allegations against Binance is that CZ commingled user funds and and sent them to third-parties. This allegation is supported by a special report by Reuters.

However, neither the SEC filing or the Reuters report alleges that these funds have been used in a fashion similar to FTX and Alameda. Rather, the allegations are that Binance commingled user funds with their own assets in a way that breaches US laws.

Binance's response

Binance has published a blog in response to the SEC's allegations, which you can read in full here.

Join the crypto conversation – Follow us on X now

Trying to get a handle on the markets? Cut through the noise with our overview of the best cryptos to buy right now, explore some strategies for how to trade crypto or see if there's a better platform for you with our guide to the best crypto exchanges.

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Disclosure: The author owns a range of cryptocurrencies at the time of writing.

Ask a question