Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseKey takeaways

- As a single parent you can still get a personal loan, but having a single income with dependents might impact your eligibility and borrowing power.

- Always calculate repayments to ensure you can comfortably manage loan costs on a single income.

- If you receive Centrelink payments, not every lender sees it as income but you might be able to access an advance payment.

What type of loans can I apply for as a single parent?

The type of loan you can apply for will depend on your financial situation as a single parent, including your credit score and income. In particular, lenders will be looking at whether your income can comfortably cover the cost of providing for your dependents as well as servicing your loan.

Types of personal loans you can apply for include:

- Secured personal loan: Typically with lower fees and more flexible eligibility criteria, you can use an asset as collateral to reduce the financial risk for the lender. You risk losing your asset if you can't repay though.

- Unsecured personal loan: Normally with slightly higher interest rates, you can borrow money without putting up an asset as collateral.

- Car loan: Finance to buy a new or used car, usually with the vehicle as collateral.

- Short term loan: Short-term loans are usually for smaller amounts and, as the name suggests, need to be paid off over a shorter loan term.

Will it be difficult to get approved for a loan as a single parent?

Being a single parent in itself isn't what makes it difficult to get a personal loan, it's the financial circumstances that might come with it.

If you're in a great position financially, you have an excellent credit score and you're working in a permanent full time job, you might not find it difficult to get a personal loan.

But if you're working part-time or casually while you raise your children and you're struggling to manage expenses, that's what can make it tricky.

Single parents may also receive Centrelink payments. Some lenders don't recognise that as a source of income and so they'll assess you based on a lower income.

Before applying for a loan, you should check the lender's eligibility criteria. If you have any questions about eligibility, you should contact the lender first.

How do I know if I can afford a personal loan on a single income?

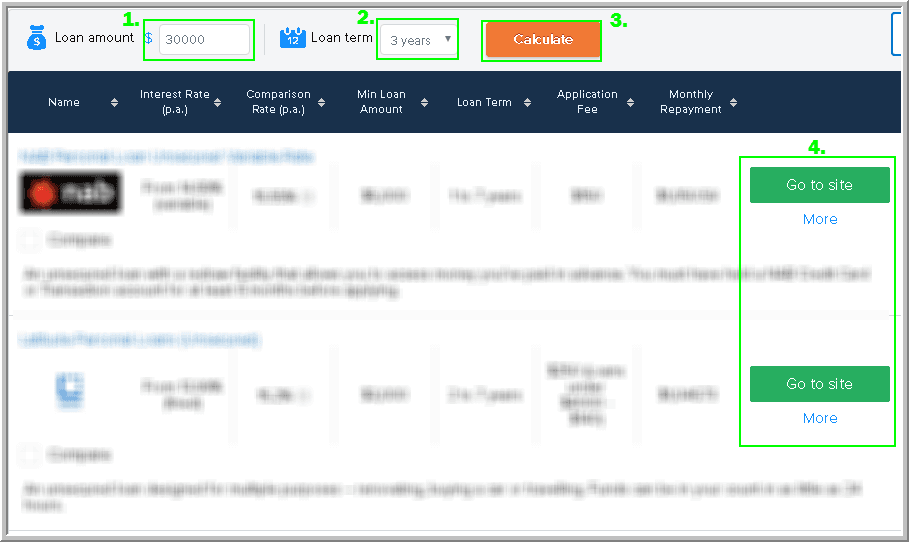

Before applying for any loan, you should consider using a personal loan calculator, like the one below. This will give you an idea of what your repayments may be. Keep in mind that this is only a guide and each lender will assess your borrowing power differently.

What can I use the loan funds for?

With both short term and personal loans, you can use the loan funds for any worthwhile purpose. With a personal loan, you can use it to do the following:

- buy a car

- pay for a holiday

- renovate your home

- upgrade your appliances

- pay your medical bills or emergency expenses

- consolidate consumer debt

What do I need to consider before applying for a loan as a single parent?

- How much does the loan cost? Consider the interest rate and fees to calculate the total cost. Take a look at the comparison rate which is a guide to the 'true' interest rate when fees are considered. Fees can include establishment and ongoing fees.

- Does it fit my budget? After you calculate the cost of the loan, you need to ask yourself if you can afford it. Will making repayments leave you out of pocket? You should only apply for a loan if it fits comfortably within your budget.

- Can I repay my loan within the given loan term? If you fail to make your repayments, there may be high fines and even legal repercussions. If you've opted for a secured loan, the lender can also repossess your asset.

- Is the loan amount sufficient for my purposes? If you borrow too much, you'll be paying interest and fees on money you don't need. If you borrow too little, you won't be able to pay for what you need and may have to take out another loan.

- Is the loan flexible? This is an important consideration as it could affect your ability to manage the loan. Does the loan allow you to make weekly, fortnightly or monthly repayments? Does the payment schedule line up with your payment frequency or will you be left out of pocket?

- Are there extra loan features? Can you make extra repayments or repay the loan early? Are there penalties or fees for any extra features?

- What is the lender's reputation? This is particularly important if you're considering short term loans. You need to check if the lender is registered with ASIC. Look into how easy the lender is to contact. This is important in case there's an emergency and you need to contact them regarding repayments. If possible, you should also read third-party customer reviews of the lender.

What to watch out for when applying for a personal loan

Borrowing money comes with risks. Here's what you should be careful of:

- Long-term repercussions and legal issues. Once you sign a loan agreement, you are bound to its conditions. You will have to pay the loan and all the fees and payments. For short term loans, you could be charged up to 200% of what you borrowed. For unsecured loans, the lender can initiate legal proceedings against you if you don't repay the loan. For secured loans, your asset can be repossessed by the lender. The lender can also report the debt to a credit reporting body like Equifax and use the services of a debt collector.

- Multiple applications. Every loan application shows up on credit reports. Several applications within a short period can hurt your credit score. This can make it harder for you to get a loan in the future. Find a single loan you're eligible for and apply only for one loan product at a time.

- Getting into debt. Debt comes with responsibilities. If you can't meet your repayments, you should contact the lender as soon as you can. If you fail to do so, you may be charged late or default fees, which will lead to more debt. Your payment history will affect your credit score – for better or worse.

How can I improve my chances of getting a loan?

- Check your credit score and report. You can check it for free on Finder. This will tell you what kind of borrowing position you're in. The higher your score, the less risky you appear to the lender.

- Improve your credit score. If your score is less than perfect, there are ways you can improve your score. Apart from paying all your bills on time, working on your savings can help improve your chances of getting a loan.

- Get financial advice. You can get in touch with a financial counsellor for free. They can take you through your financial options. Give the hotline a call on 1800 007 007.

- Apply for a lower amount. You should only borrow as much as you need and can realistically afford. Instead of offering you a lower amount, lenders may reject your application if they think you can't afford the repayments.

- Talk to the lender before you apply. Discuss your eligibility with the lender before applying. Remember that every loan application will appear on your credit report. Too many applications in a short space of time will affect your credit score and chances of future credit.

- Offer loan security. By offering security, you're reducing the lender's risk of lending to you. This may make them more amenable to providing credit. Keep in mind that secured loans come with the risk of losing your asset. If you fail to make your repayments, the lender can repossess the asset to cover their cost of lending.

What are the alternatives to personal loans?

If you don't think you'll be eligible for a personal loan, you might be able to consider one of the following:

- 0% interest financing from retailers.Some retailers offer interest-free periods on the sale of their goods and appliances. For instance, The Good Guys offers up to 60 months interest-free on home appliance purchases with a minimum spend in-store or online.

- No Interest Loan Scheme (NILS). This loan is for low-income earners. It is offered by 170 local community organisations across 600 locations in Australia. You can borrow up to $1,500 to pay for bills and essentials, with terms ranging from 12 to 18 months. As the name implies, no interest is charged. You will only pay for what you borrow.

- Centrelink Advance Payment. This allows you to receive an advance payment on your Centrelink benefits. This is not an additional payment, but a part of your existing allowance paid in advance. You may be eligible depending on how long you have been with Centrelink and how much you receive. There are also other loans you can apply for if you're on Centrelink.

- StepUP personal loan. If your income is small, you could be eligible for a StepUP personal loan. This program is managed by Good Shepherd Microfinance in partnership with NAB. With this loan, you could borrow between $800 and $3,000, with a loan term of up to 3 years. The interest rate is fixed at 5.99% p.a.

- Buy now, pay later .You can make interest-free purchases and pay in instalments. Many retailers now offer this option, allowing you to break down your repayments into smaller, more manageable chunks. There are also buy now pay later services that let you pay your bills in instalments.

- Pay on demand apps. If you're out of pocket, you could look into pay on demand. This is a type of short term loan where you can borrow a portion of your pay cheque before your payday. You are technically borrowing your own money in exchange for a small fee. These fees can be from $2 to $10 or up to 5% of the total borrowed money. The idea of these loans is to tide you over until payday.

- Interest free credit cards. Another alternative is a 0% interest credit card. Keep in mind that after the introductory period, the interest rate reverts to the standard rate. When that happens, you'll be charged interest on the balance you haven't paid off during the 0% p.a. period.

How can I apply for a single parent loan?

- Compare lenders. Look at the fees, terms and eligibility criteria and find a loan that suits you.

- Gather all of the required documents, like identity verification, payslips and bank statements.

- You can then usually complete the application via the lender's website.

- If the lender needs any further information from you, they'll be in touch.

Frequently Asked Questions

Sources

Why compare personal loans with Finder?

Addicted to details. We know taking out a personal loan is something you'll be hooked up with for a while. That's why we put hours into research for this guide (and still do at least once a month)

Addicted to details. We know taking out a personal loan is something you'll be hooked up with for a while. That's why we put hours into research for this guide (and still do at least once a month)

Rates obsessed. Lenders come in all shapes and sizes, that's why we don't just track the big banks, but all the digi folk too. Pretty much everyone but your parents to be honest.

Rates obsessed. Lenders come in all shapes and sizes, that's why we don't just track the big banks, but all the digi folk too. Pretty much everyone but your parents to be honest.  Cash for whatever you need. Lending rates verified from 180+ products day and night. Whether you're buying a car, rennovating your home or heck just ready to let loose with the spending - we got you.

Cash for whatever you need. Lending rates verified from 180+ products day and night. Whether you're buying a car, rennovating your home or heck just ready to let loose with the spending - we got you.

Ask a question

6 Responses

More guides on Finder

-

OurMoneyMarket Unsecured Low-Rate Personal Loan ($20,000-$100,000)

A marketplace personal loan with personalised interest rates.

-

OurMoneyMarket Secured Personal Loan

Read Finder's review of OurMoneyMarket's Secured Personal Loan. See if this loan is right for you.

-

MoneyPlace personal loan

This secured loan may be used for any worthwhile purchase and requires security against a vehicle. It uses risk-based pricing, so your interest rate will be set based on your credit score and history.

-

NOW Finance Secured Personal Loan

A risk-based personal loan from one of Australia's biggest non-bank lenders. Get a personalised rate which rewards higher credit scores.

-

Plenti Personal Loans

Looking for a competitive rate? Plenti offers loans funded by investors with rates that are tailored to your personal circumstances.

-

ING Personal Loan

An ING personal loan offers certainty with fixed interest rates and fixed repayments over a set term.

-

Joint Personal Loans

If you're wanting to bolster your application, buy an asset with your partner or apply for a loan you're not eligible for by yourself, you can consider a joint application personal loan.

-

Personal loans for temporary residents

Temporary Australian residents may be eligible to apply for personal loans, depending on the visa they hold.

-

Best personal loans Australia

Finder's experts look into our database of over 200+ personal loans each month to bring you our Top Picks across 5 key categories.

-

Low interest personal loans in Australia

Find a low interest loan by comparing your options with Finder. See interest rates, fees, and features for loans across Australia, plus guides to help you get the best deal.

Single now was doing well but things have got hard with having a son with alot of health problems and looking to find a better loan for my car as im paying $400 a forenight and a few little bills that i keep put off and with the cost of living going up, just need a helping hand to put me on the right path.

Hi Jodi,

Thank you for your inquiry.

With Personal Loans for Single Parents, if you’re looking to apply for a personal loan you can first compare your options using the comparison tables on this page and across finder.com.au. Once you’ve found a loan that you want to apply for, review the application requirements and click ‘Go to Site’ to be redirected through to the lender’s online application form.

I hope this information has helped.

Cheers,

Harold

Hi I work part-time I am a certified massage therapist I work out of my house I just recently lost my job with Home Depot so I only have my self employed right now I am a single parent with 3 kids to provide for I am a little behind on one or two payments and I just need help financially so that way I don’t lose everything that i worked hard for.looking for a company that will loan me money and I can pay in payments over time

Hi Priscilla,

Thanks for your inquiry.

You might want to consider some of the low doc personal loansthat are designed for self-employed applicants, or if these loan amounts are too much, there are also payday loans you can check out. You may also consider other Government and community financial assistance options.

If you’re looking for personal advice you can consider calling the free financial counseling service on 1800 007 007.

I hope this information will be of use.

Thanks,

Elizabeth

I’m a single mum of a 8 month old and a 2 yr old I’m on a parenting payment in and benifits. I have had a bad past where my ex has left bad credit on my file. I’m looking to start again as I had to sell my car for my father’s funeral as well as taken out some small time loans coz no one would help me. I’m looking for a personal loan to buy a second hand car as I really need and to put all my bills in one payment with a little bit to spare can u plz help me I’m as far down as I can go and I would love for something to go right. No matter how hard I try I can’t seem to be the best I know I can be. It is cheap to buy a house then rent. Anything anything at all. Can u help me

Hi Sarah,

Thanks for your question and sorry to hear about your situation.

You might want to take a look at this page that provides a guide on borrowing when you’re unemployed, towards the bottom of the page is also a list of alternative loan options you might want to consider that include no and low interest loans schemes. We cannot offer any personal advice but you can get free financial advice by calling the Free Financial Counselling hotline on 1800 007 007.

I hope this has helped.

Thanks,

Elizabeth